- Why you might seek alternatives to an SBA loan.

- The pros and cons of receiving a commercial loan.

- How to find a commercial lender.

- How you can use seller equity to fund an acquisition.

- The basic steps for setting up a ROBS (Roll-Overs As Business Start-Ups).

Acquira was created to help investors take advantage of a huge generational opportunity. Ten-thousand baby boomers are retiring every day while 16 million business owners will be at or above retirement age in the next ten years. Over 3 million of those businesses are employer firms, representing trillions of dollars of potential acquisition candidates. This has led more and more people to pursue acquisition entrepreneurship as a viable investment opportunity.

After deciding that they want to acquire a business, one of the first things that many Acquisition Entrepreneurs will look into is funding.

Most people aren’t sitting on enough liquid cash to simply buy a business outright. And even if they were, that’s usually not a good idea. Instead, most buyers will put down a percentage of the purchase price while the rest of the payment is made through a loan that the buyer will pay back, with interest, over a period of years.

The task of coming up with that sum of money – in many cases millions of dollars – can be daunting. And worst of all, not understanding how to finance a business acquisition could lead you to select the wrong business, one that is too small which would mean a higher risk. Fortunately, there are a number of resources available to business buyers.

In many cases, Acquisition Entrepreneurs (AEs) will turn to a Small Business Administration (SBA) loan to help fund the purchase.

The SBA itself doesn’t fund loans but serves as a guarantor, guaranteeing payment to the lender, for a portion of the loan, in case the loan defaults. For lenders, this mitigates the risk of lending money.

SBA offers a number of benefits, including relatively low interest rates, favorable repayment terms, and a low down payment. However, in order to be approved for a loan from the SBA you must have good credit and put down a personal guarantee or collateral. Not to mention, the process can be long and taxing.

For many people, SBA simply isn’t an option for a variety of reasons. Perhaps they want to close on the deal quickly and the SBA process will take too long, or maybe they anticipate problems with the licensing requirements that the SBA lender demands. Fortunately, in those types of situations there are alternative business loans.

In this article, we’ll walk you through various acquisition finance options that don’t require an SBA loan. From commercial loans to ROBS, we’ll lay out the various paths so you can choose the one best suited to you.

1. Commercial Loans

As Investopedia says, “A commercial loan is a debt-based funding arrangement between a business and a financial institution such as a bank.”

Commercial loans allow you to get the necessary funding while avoiding the pitfalls of SBA loans, such as the need to personally guarantee a portion of the loan, restrictions on seller retention, and the general unpopularity of SBA loans with brokers. If you’re able to qualify, this type of loan can often be your best option. In order to qualify for a commercial bank loan, you need a down payment of at least 30 percent. Some lenders will accept the seller's note as part of that 30 percent, considering it long-term financing that reduces the Loan-to-Value (LTV) ratio, rather than equity.

| Loan-to-Value Ratio: This is a financial term used by lenders to express the ratio of a loan to the value of an asset purchased. It is calculated by dividing the amount borrowed by the appraised value of property. That calculation is expressed as a percentage. |

As of April 2022, commercial loans were offering interest rates of 4-5 percent. They are often variable but are fixed annually. The amortization rate for a commercial loan is usually around four to five years, with the possibility of longer amortization if the business has substantial amounts in real estate. However, this can make for hefty principal repayments compared to SBA loans which, depending on the size of your down payment, could be a disadvantage.

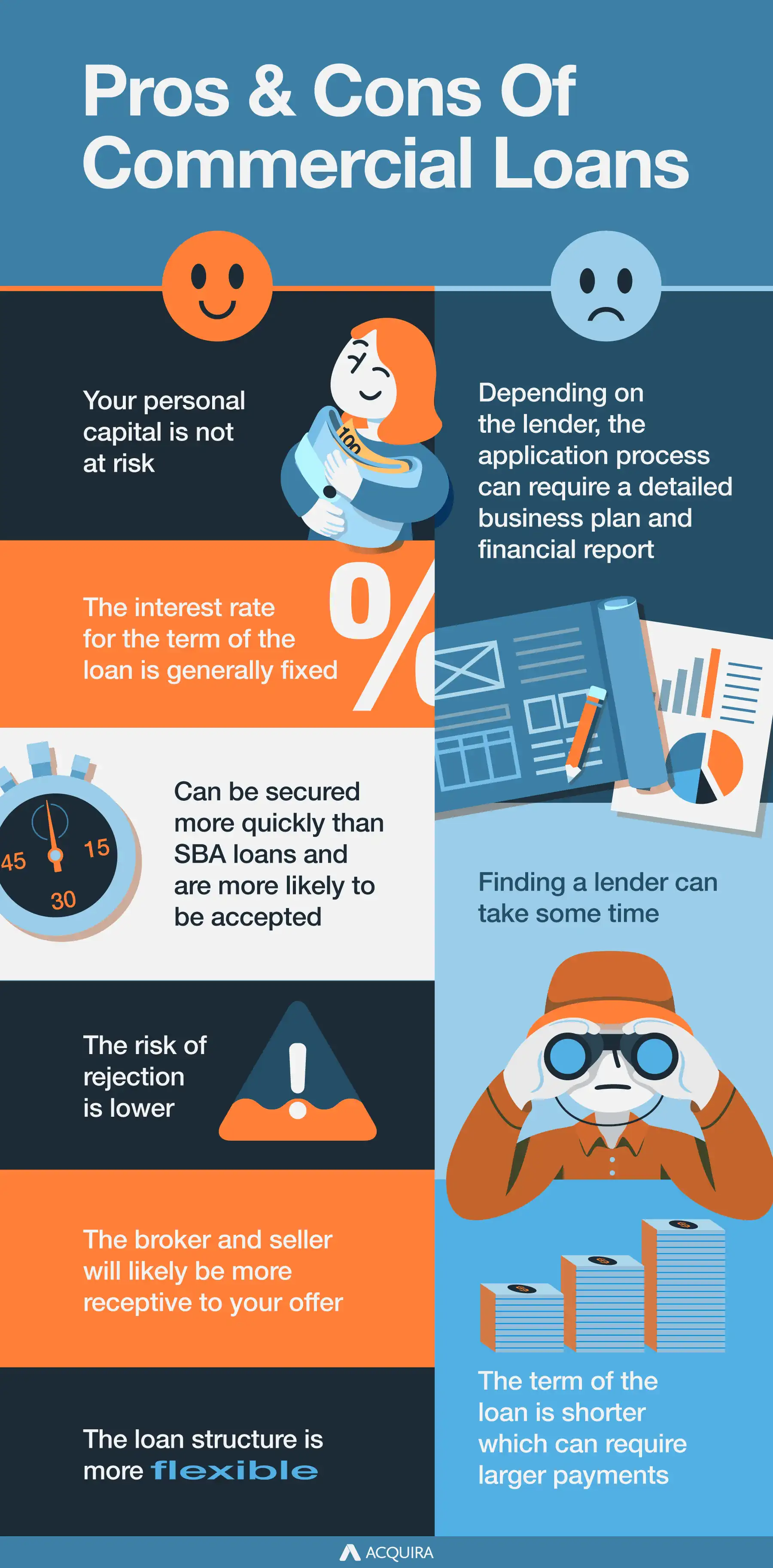

Pros Of Commercial Loans

- Your personal capital is not at risk, as it is with SBA loans.

- The interest rate for the term of the loan is generally fixed.

- Commercial loans can be secured more quickly than SBA loans and are more likely to be accepted.

- The risk of rejection is lower.

- The broker and seller will likely be more receptive to your offer.

- The loan structure is more flexible, especially with regard to the seller’s participation in your deal.

Cons Of Commercial Loans

The way you’re able to use the funds is less flexible. When applying for a commercial loan, the borrower must specify what the money will be used for and how it will pay back the loan. This can make it difficult to adapt. Moreover:

- Depending on the lender, the application process can require a detailed business plan and financial report (which is also true of an SBA loan).

- Finding a lender can take some time.

- The term of the loan is shorter which can require larger payments.

Finding a Commercial Lender

Finding a bank that will give you a commercial loan is a numbers game. You may contact as many as 50 banks, resulting in perhaps 30 conversations with lending officers in order to get ten term sheets showing the non-binding terms and conditions of the loan they might make to you.

Obviously, the stronger your position the easier your search will be but you should not be tempted to settle with the first lender who is willing to move forward with you. Banks vary considerably in their general risk tolerance which will affect their assessment of the quality of your business.

2. Seller Equity

If you were to fund your acquisition through an SBA loan, the amount of time that the seller is allowed to stay with the business is limited to a maximum of one year. But for many new business owners, having the seller stick around can help them through the difficult transition period of becoming a new owner.

Not to mention, if you don’t get an SBA loan it opens new funding avenues as far as seller retention.

In the case of an equity sale, it is important that you retain control in decisions affecting the business

For example, you could seek the seller’s equity participation, all the way up to 100% of the purchase amount less your contribution. This type of arrangement makes sense in a scenario where you can make a 20 percent down payment but would like to secure a commercial loan. However, in the case of an equity sale, it is important that you retain control in decisions affecting the business. Also, if you intend to keep the owner around over the medium- or long-term, it’s vital that you have a comfortable working relationship with them.

The seller and their license can retain day-to-day involvement in the business for as long a period as you have stipulated in your contract with them. Again, if you do this it is imperative that the two of you have a congenial working relationship.

You can include in the LOI and in the APA (Asset Purchase Agreement) one or more earn-out provisions. Earn-out provisions stipulate that the buyer will pay just a portion of the sale price up front and the remainder will be paid based on future performance of the business, after the buyer has taken over, and at a stipulated date. This helps resolve price disagreements between buyer and seller, reduces the risk for the buyer, and gives the seller more incentive to make the business succeed if they have stayed behind to work in it.

You can include in the LOI and in the APA one or more holdback provisions. A holdback provision is an agreement that an amount is held back from the sale until a certain condition stipulated in the APA has been fulfilled, and at a stipulated date. This provision accomplishes the same goals as the earn-out above, but might be perceived by the seller as a little more of a stick than a carrot.

3. Institutional Investors (AKA Private Equity)

Private equity investors are typically only interested in businesses that make at least $2.5 million in EBITDA, which usually trade for over 4x. They will also want to see substantial skin in the game in the form of a personal investment in the business, so if you don’t have at least $1 million in personal capital to invest, they are likely not a suitable partner.

If the private equity firm chooses to invest with you, they can do so via either equity or debt (or a combination). With debt, the business is expected to pay interest for the full amount of the debt, increasing financial expenses and adding pressure to the cash flow, but keeping you as the sole shareholder.

With equity, the business does not have to pay interest unless certain thresholds are met, which can be negotiated. However, the investor receives a minority portion of the interest in the business and would benefit from dividends and the sale of the business.

In both cases, you could expect the private equity to require or impose restrictions on a number of matters, including governance. That is why you want to make sure you read and understand the small print.

If you do decide to raise debt with a private equity firm or anywhere else, make sure that you do not cripple yourself with payments on it. Your available cash flow, or debt service coverage ratio, should stay above about 1.8. This typically implies a five-year amortization and an interest rate no higher than 12%. Balloon payments, where you pay interest only in the early period of the loan, may be helpful.

4. Angel Investors

Angels are typically friends, family, or high net worth individuals (HNWI). They will write checks in the amount of $50,000 to $500,000 and in many cases will take an equity stake in the business in return.

If you need help with your down payment, you might need a funds injection from just one or two people. Even if you are getting SBA financing, your investors will not need to risk more than the money they are investing. That’s because there is no collateralization if they are giving you less than 20% of the total down payment. It’s important to know that your angel investors’ money should go into your account at least three months prior to your loan application, as the SBA wants to see it “seasoned.”

| Note: In the context of funding an acquisition, loan seasoning refers to the length of time that the funds used for the payment have been in your account. |

If you’re seeking a substantial total amount from investors who can only give on average $50,000 each, bear in mind that administration and investor relations are likely to be a hassle. The other inconvenience is that, often, these investors are not qualified or certified and may have unrealistic expectations, or just take too much time from you asking questions or interfering with the business decisions. Thus, this type of fundraising is best done for smaller total investments.

We have seen a wide range of terms in this type of equity investment, but most often investors get a return in line with the equity value of the deal. So if you are acquiring the business at a 3x EBITDA multiple, each investor will make a 33 percent return on the money they have put in, assuming no growth or decline in earnings.

5. ROBS

ROBS, or Roll-Overs As Business Start-Ups, are a more complex funding option for business acquisitions. In order to make use of a ROBS plan, you need to set up an incorporated business. C corporations are the only businesses eligible to participate in ROBS simply because they have the ability to sell stock.

Once that C corp has created a qualified retirement plan, you can roll over your existing retirement funds (ie: your 401(k)) and use that new retirement account to buy shares in your corporation. Proceeds from the sale of the stock can be used for part or all of your down payment, working capital, capital expenses, and more.

The relatively complex nature of ROBS means that you should use a firm that specializes in their creation. The fee charged by this firm is typically flat and around $4,000-$5,000. Therefore it is more cost-effective to move a relatively large amount out of your 401(k) via ROBS.

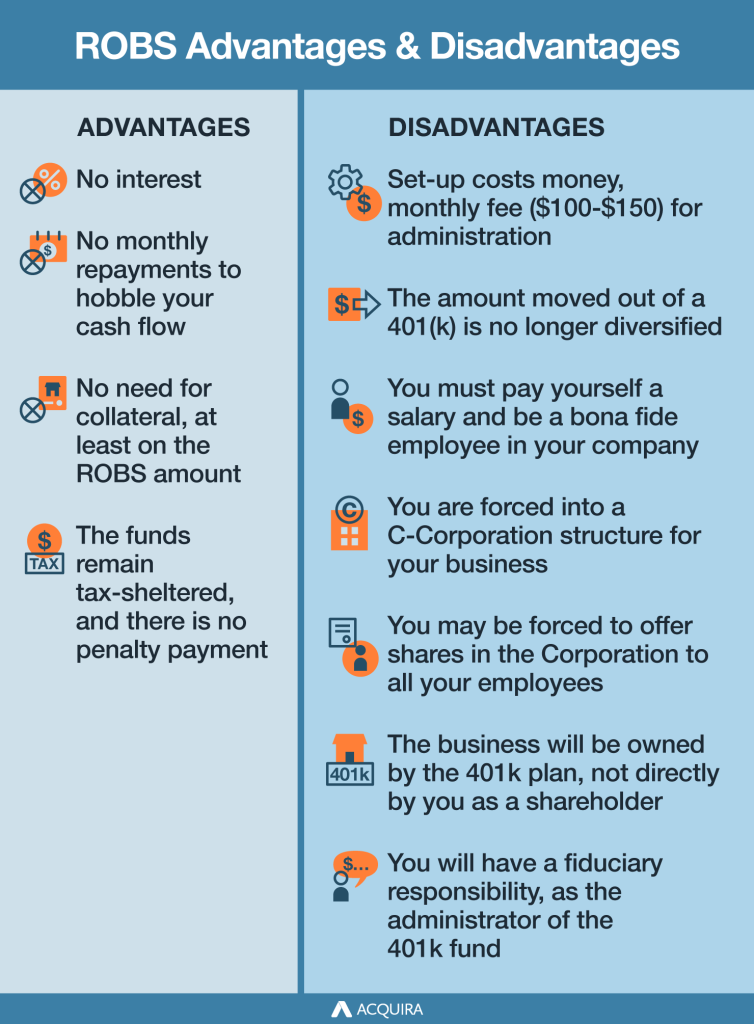

The advantages of ROBS are manifest:

- no interest

- no monthly repayments to hobble your cash flow

- no need for collateral, at least on the ROBS amount

- The funds remain tax-sheltered, and there is no penalty payment.

But there are disadvantages too:

- Set-up costs money, and then there is a small monthly fee ($100-$150) for administration.

- The amount you’ve moved out of a 401(k) is no longer diversified.

- You must pay yourself a salary and be a bona fide employee in your company. One company that specializes in ROBS suggests that to be safe you should work 1,000 hours or more annually.

- You are forced into a C-Corporation structure for your business (see discussion in the chapter on Taxation).

- You may be forced to offer shares in the Corporation to all your employees. While highly unlikely, this could potentially result in a loss of control.

- The business will be owned by the 401k plan, not directly by you as a shareholder. This has tax and legal implications.

- You will have a fiduciary responsibility, as the administrator of the 401k fund

There are four basic steps required to set up ROBS.

- A C-Corporation is set up to hold the rolled-over amount. This will also be the acquiring entity for your new business.

- A new retirement plan – usually a 401(k) plan – is set up within the C-Corporation, and you appoint a plan custodian to administer your investments in the plan.

- All of part of your retirement fund is rolled over from the original 401(k) plan to the new one within the C-Corporation. Thus, it’s now the company’s retirement plan.

- The company’s retirement plan buys shares in the C-Corporation – that is, it exchanges up to 100% of the rolled-over funds for Qualified Employer Shares (QES).

The initial $5,000 set-up fee covers the cost of creating the C-Corporation and a 401(k) plan inside it and takes about a month. So if you are counting on using the money as a down payment on an SBA or commercial bank loan, you need to ensure the deadlines are as synchronized as possible.

6. Balloon Loans, Kickers, and Warrants

A balloon loan is a loan in which very little or no principal is paid until the end of the loan period, at which time a large payment for the remaining principal balance is due. This is attractive for business buyers who plan to spend a lot of money initially on improving their business and may only start to see growth at the end of the first year. Where necessary the borrower may pay off the balloon payment at the end of the loan’s term by taking out another loan or refinancing.

A kicker is also known as a sweetener. It is something that is added to a deal to get it done, or to secure an interest rate that is lower than the market would expect. A kicker could be a reward of equity, for example, for every dollar that an investor puts into debt.

One form of kicker is an exercisable warrant.

Technically, warrants (sometimes known as options) are a derivative financial instrument that gives the right, but not the obligation, to buy or sell a security at a certain price before it expires. They are issued by companies. You may see warrants described as traditional, wedded, naked, or covered.

Conclusion

Acquira was created to help investors take advantage of the generational opportunity that has arisen around small businesses. We are seeing more people than ever pursue acquisition entrepreneurship as a means to find self-fulfillment and self-ownership. It’s a concept we call the Third Path.

However, in order to pursue that opportunity, acquisition entrepreneurs first need to secure funding for their deals. That funding can come from commercial loans or other non-SBA business acquisition loans.

Whatever course you take, be sure to seek the advice of your legal team before committing to any single funding plan.

Have you had any luck securing funding from a non-SBA loan? We’d love to hear about it in the comments.

Acquira exists to help people buy businesses, grow those businesses, and exit them for more than what they paid. Much of the above article was taken from The Last Mile unit of our training, which begins with the Accelerator Program. To learn how we can help you on your journey, schedule a call with us now.

Key Takeaways

- In order to be approved for an SBA loan you must have good credit and put down a personal guarantee and collateral.

- As part of an SBA loan, the seller cannot remain with the company for more than one year.

- Alternative business lending options are available!

- Commercial loans allow you to get the necessary funding while avoiding the pitfalls of SBA loans.

- Depending on the terms of the deal, seller’s equity participation can cover up to 100% of the purchase amount less your contribution.

- Funding through Angel Investors is best done for smaller total investments.

- The relatively complex nature of ROBS means that you should use a firm that specializes in their creation.