- Why a Confidential Information Memorandum is key to business acquisitons

- The critical components of a CIM

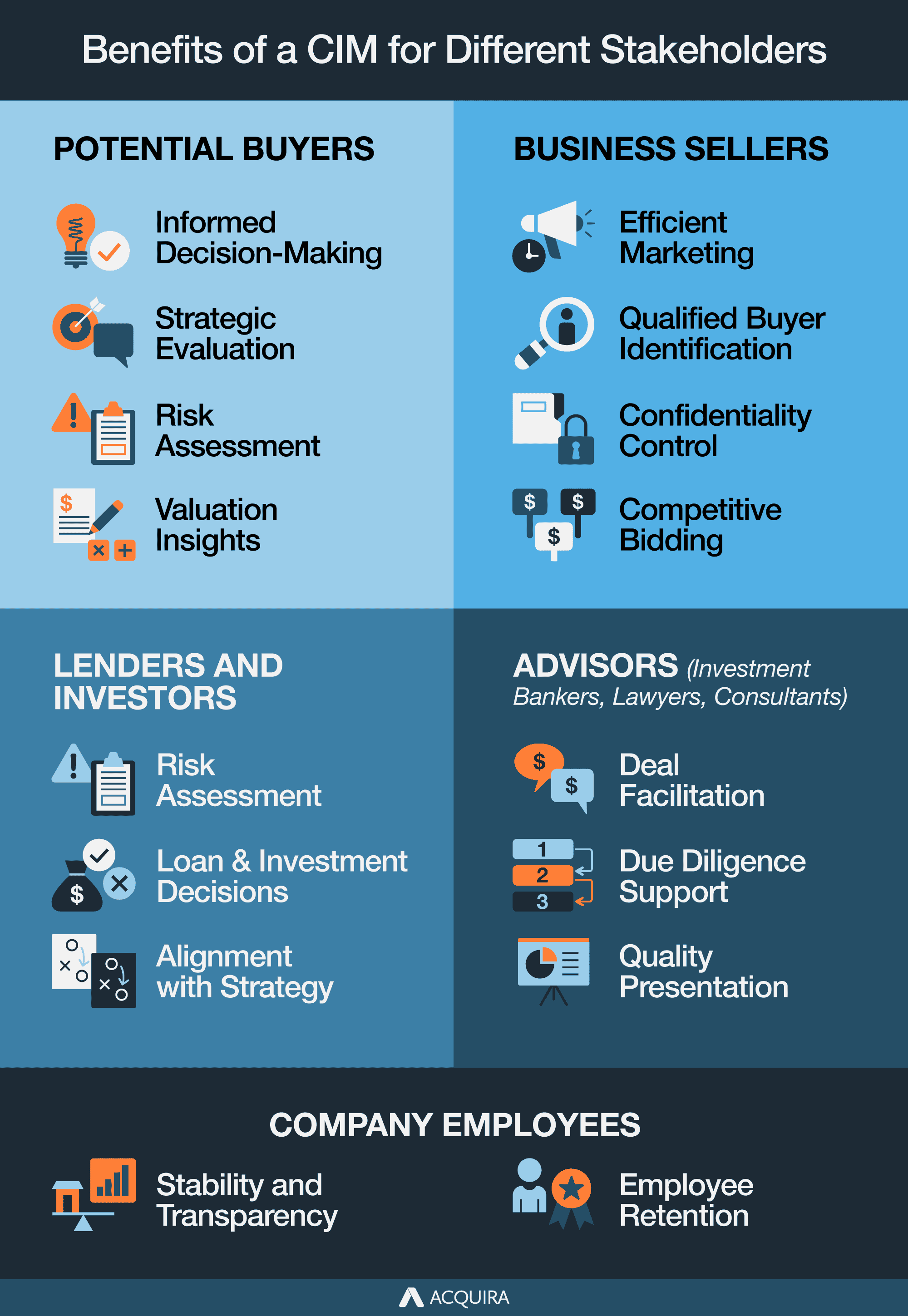

- The benefits of a CIM for different stakeholders

Making informed decisions is integral in any acquisition.

The most powerful tool any business buyer has to accomplish is the Confidential Information Memorandum (CIM).

A good CIM should break down the oftentimes complex financial and structural aspects of a business, so that buyers can more easily assess the overall health of a potential acquisition target.

A properly written CIM contains pertinent financial information, strategic plans, operational strengths, and potential growth opportunities. The document guides both parties in business negotiations, ensuring that opportunities are taken advantage of, and risks are managed.

Let’s take a closer look at CIMs, what you should look for in a CIM, and how to use that information to assess a business.

What is a CIM or Confidential Information Memorandum?

A CIM, often called the “book” or “deal book,” is a comprehensive and confidential informational package that provides detailed insights into the target company’s financial, operational, and strategic aspects. The purpose of the CIM is to present a comprehensive overview of the business being offered for sale while maintaining high confidentiality throughout the due diligence process.

The purpose of the CIM is to present a comprehensive overview of the business being offered for sale while maintaining high confidentiality throughout the due diligence process.

Importance of CIM in Business Acquisition

The CIM bridges sellers and potential buyers by offering a structured and detailed depiction of the business’ history, industry landscape, competitive positioning, growth prospects, and financial performance.

It goes beyond the surface-level information in marketing materials. It acts as a marketing document that gives every prospective buyer a deeper understanding of the target company’s strengths, weaknesses, opportunities, and threats.

By sharing this in-depth information, sellers aim to attract serious and well-informed buyers who are more likely to align with the company’s values and growth trajectory.

Buyers can benefit from the CIM as it provides a helpful resource for evaluating a business’s potential fit with their strategic goals and investment criteria. Through a preliminary assessment, they can determine the company’s viability and alignment with their acquisition strategy.

The CIM helps potential buyers make informed decisions by providing the necessary data to assess risks and opportunities associated with the acquisition, allowing them to measure whether the investment aligns with their desired outcomes.

Key Components of a CIM

A well-written CIM should include an overview of the company’s operations, financials, industry landscape, and growth prospects. Here’s a detailed description of the key components that should be included in a CIM:

Executive Summary

The Executive Summary section concisely details the company’s key highlights, including its industry, products or services, competitive advantage, financial performance, and growth potential. It’s designed to provide a quick snapshot of the business.

Company Overview

The CIM delves into the company’s history, mission, and values here. It provides context for the company’s establishment, journey, and strategic positioning within the industry.

Industry/Market Analysis

This section offers a comprehensive assessment of the industry or a market overview in which the company operates. It includes market size, growth trends, competitive landscape, and potential challenges or opportunities. Prospective buyers must understand the external factors that could impact the company’s performance.

Financial Performance

This is one of the most crucial sections that covers the company’s historical financial statements (income statement, balance sheet, and cash flow statement) over the past few years. It helps potential buyers assess the company’s financial health, profitability, and stability.

Business Model

The CIM outlines the company’s revenue streams, customer segments, distribution channels, and value proposition. It clearly explains how the company generates income and adds value to its customers.

Operational Overview

This component provides insights into the company’s operational processes, manufacturing capabilities, supply chain, and distribution networks. It helps a potential buyer assess the company’s ability to efficiently deliver its products or services.

Products and Services

This section provides detailed information about the company’s offerings, features, benefits, and unique selling points. It also highlights any intellectual property, patents, or proprietary technology associated with these offerings.

Transaction Details

This component outlines the terms of the proposed acquisition, including the purchase price, deal structure, payment terms, and any contingencies. It provides clarity on what the buyer can expect during the acquisition process.

Marketing and Sales Strategy

The CIM describes the company’s marketing and sales efforts, including customer acquisition strategies, branding initiatives, and competitive positioning. A potential buyer evaluates the company’s ability to attract and retain customers.

Projections and Forecasts

All of the buyers are interested in the company’s future performance. This section includes financial projections and forecasts detailing anticipated revenue, expenses, and profitability. Realistic and well-supported projections are essential for buyers to assess potential returns on investment.

Competitive Landscape

This section analyzes the company’s competitors, their strengths and weaknesses, market share, and differentiation strategies. Buyers need to gauge how the company stands out in its industry.

Management Team Overview

Here, the CIM introduces key management team members, their roles, expertise, and track records. Buyers want to understand the leadership that drives the company’s post-acquisition growth.

Risk Factors

Every business carries inherent risks. This section outlines potential risks impacting the company’s operations, finances, or growth trajectory. It allows buyers to assess risk exposure and devise mitigation strategies.

Use of Proceeds

If the company is seeking funding for growth or other purposes, this section explains how the funds from the acquisition will be utilized. It helps buyers understand the company’s strategic priorities.

Confidentiality and Legal Disclaimers

Given the sensitive nature of the information in the CIM, this section includes legal language regarding confidentiality agreements, limitations on distribution, and disclaimers about the accuracy of the information provided.

Not All CIMs Are Created Equally

At Acquira, we have collectively looked at thousands of CIMs and helped our Acquisition Entrepreneurs look at thousands more. In fact, we have created proprietary tools that leverage AI to help us analyze CIMs faster so we can assess deals faster.

Through this work, we have seen that not all CIMs are created equally. Or, more plainly, some CIMs just suck.

They can be plagued by missing information, have too much information, have information that is poorly presented and hard to understand, or contain straight-up lies.

One good aspect of this is that a poorly written CIM can be a red flag, showing that a business seller isn’t serious or has not kept good track of their financials. If you notice important information missing, don’t hesitate to ask the broker or seller about it.

CIM Confidentiality and Security

Maintaining the confidentiality and security of the information the Confidential Information Memorandum (CIM) provides is crucial to protect the interests of both the seller and potential buyers. Here’s how confidentiality and security are ensured:

Non-Disclosure Agreements (NDAs)

Before potential buyers are granted access to the CIM, they are typically required to sign a Non-Disclosure Agreement (NDA) or Confidentiality Agreement. The NDa is a legally binding contract. This document outlines the terms and conditions of confidentiality, specifying that the recipient will not disclose or use the confidential information for any purpose other than evaluating the potential acquisition. NDAs often include provisions for the return or destruction of the information if the transaction doesn’t proceed. NDAs typically include clauses allowing the seller to seek legal remedies in case of a breach of confidentiality. This discourages potential buyers from violating the terms of the agreement.

Controlled Distribution

Sellers often manage the distribution of the CIM to potential buyers. They may share the CIM only with qualified and serious buyers who have been vetted to ensure their genuine interest and ability to complete the transaction. This controlled distribution minimizes the risk of unauthorized dissemination of confidential information.

Watermarked Documents

Some CIMs are distributed in digital formats with watermarks uniquely identifying the recipient. This discourages recipients from sharing the document, as any leaked information can be traced back to them.

Secure Virtual Data Rooms

Many sellers use secure virtual data rooms (VDRs) to manage the distribution of the CIM and other confidential documents. VDRs provide a controlled environment where access to documents can be monitored and restricted. They often include features such as document expiration, access logs, and user permissions.

Limited Information Sharing

In the initial stages, sellers may provide a teaser or a high-level overview of the opportunity without revealing sensitive details. This helps gauge potential buyers’ interest before sharing the full CIM.

Redacted Information

Sometimes, sensitive information may be redacted or withheld from the initial CIM. This allows potential buyers to evaluate the opportunity while protecting the most sensitive details until a later stage of due diligence or negotiations.

Data Encryption

Digital copies of the CIM may be encrypted to prevent unauthorized access. This ensures that the content remains protected even if the document falls into the wrong hands.

Benefits of a CIM for Different Stakeholders

A well-prepared Confidential Information Memorandum (CIM) offers a range of benefits to different stakeholders involved in the business acquisition process. Here’s how various stakeholders benefit from a CIM:

Potential Buyers

- Informed Decision-Making: Buyers gain access to in-depth information about the target company’s financials, operations, industry landscape, and growth prospects, enabling them to make well-informed decisions.

- Strategic Evaluation: The CIM helps buyers assess how the target company aligns with their strategic goals and whether the acquisition will contribute to their long-term business objectives.

- Risk Assessment: Buyers can identify and evaluate potential risks and challenges associated with the acquisition, allowing them to understand the potential downsides of the investment better.

- Valuation Insights: The financial information provided in the CIM aids buyers in evaluating the company’s valuation and determining the fairness of the proposed purchase price.

Business Sellers

- Efficient Marketing: A CIM enables sellers to efficiently market their business to potential buyers by acting as a marketing document by presenting a comprehensive and compelling overview of the company’s strengths, financials, and growth potential.

- Qualified Buyer Identification: The CIM helps identify serious and qualified buyers with a genuine interest in the company, ensuring that the seller’s time and resources are focused on viable prospects.

- Confidentiality Control: By sharing detailed information in a controlled manner, sellers can maintain confidentiality while still providing valuable insights to potential buyers.

- Competitive Bidding: A well-structured CIM can generate interest from multiple eligible buyers, potentially leading to a competitive bidding environment that drives up the value of the acquisition.

Lenders and Investors

- Risk Assessment: Lenders and investors can assess the target company’s financial performance, growth potential, and overall risk profile based on the detailed information provided in the CIM.

- Loan and Investment Decisions: The financial projections and historical data in the CIM aid lenders and investors in making informed decisions regarding loan terms or investment amounts.

- Alignment with Strategy: Investors can evaluate whether the target company aligns with their investment strategy and risk appetite, leading to more confident investment decisions.

Advisors (Investment Bankers, Lawyers, Consultants)

- Deal Facilitation: Advisors can use the CIM to facilitate discussions between buyers and sellers, acting as negotiation intermediaries.

- Due Diligence Support: The comprehensive information in the CIM streamlines the due diligence process, making it easier for advisors to conduct thorough assessments on behalf of their clients.

- Quality Presentation: Advisors can enhance their professional reputation by delivering a high-quality CIM demonstrating their expertise in preparing compelling acquisition materials.

Company Employees

- Stability and Transparency: If the company’s employees are aware of the potential acquisition, a well-structured CIM can provide reassurance about the future direction of the company and its potential for growth under new ownership.

- Employee Retention: Transparency through the CIM can help retain key employees by addressing concerns and uncertainties about their roles in the event of an acquisition.

Conclusion

The Confidential Information Memorandum (CIM) stands as a foundational document in business acquisition. It encapsulates detailed insights into the target company’s operations, financials, and growth prospects, aiding sellers in attracting potential buyers to make informed investment decisions. Its role in maintaining confidentiality while sharing critical information underscores its significance as a tool for fostering successful and well-informed business transactions.

By making a well-structured and thorough CIM, a business owner can attract serious buyers, facilitate due diligence, and, ultimately, complete a business acquisition transaction. The confidentiality and security of a CIM are meticulously managed through a combination of legal agreements, controlled distribution, technological tools, and prudent communication. These measures are implemented to safeguard sensitive information and maintain the integrity of the business acquisition process.

Always remember that an effective CIM must strike a balance between providing comprehensive information and maintaining confidentiality. By carefully crafting the content and structure of the CIM, you increase your chances of capturing the attention of qualified buyers who are genuinely interested in the acquisition opportunity.

If you are a business owner planning to sell your business, consider partnering with Acquira. Our mission is to partner with business owners, provide them with quick, straightforward exits, protect their team and culture, and keep their businesses operating for the long term.

Key Takeaways

- A CIM is a confidential document that details a company’s financial, operational, and strategic aspects for potential buyers. It provides a comprehensive overview while keeping confidentiality during due diligence.

- A CIM includes an exec summary, company overview, market analysis, financial performance, operations, marketing and sales strategy, projections, management team overview, risk factors, and legal disclaimers.

- To create an effective CIM strategy, understand your audience, detail relationships, identify growth opportunities, present professionally, write clearly, and create custom versions.

- A well-prepared Confidential Information Memorandum benefits various stakeholders, including business sellers, buyers, lenders, investors, advisors, and company employees.

Acquira specializes in seamless business succession and acquisition. We guide entrepreneurs in acquiring businesses and investing in their growth and success. Our focus is on creating a lasting, positive impact for owners, employees, and the community through each transition.