- An in-depth understanding of what Debt Service Coverage Ratio (DSCR) is and why it’s crucial for businesses and individuals.

- How to calculate DSCR using its standard formula, including examples for better comprehension.

- The significance of DSCR in securing loans, managing debt, and carrying out long-term financial planning.

- Factors that can affect the DSCR value, including revenue, expenses, and external economic conditions.

- Practical tips and strategies to improve your DSCR for a healthier financial outlook.

One way to measure the financial health of any business is the debt service coverage ratio – a metric that shows how well it can manage and service a given level of debt.

Whether you’re an entrepreneur considering a new investment, a small business owner evaluating your company’s financial stability, or an individual trying to grasp your ability to manage debt, understanding DSCR is imperative.

So let’s take a closer look at DSCR, why it’s vital, and how it can be a powerful tool for financial decision-making.

Debt Service Coverage Ratio

Debt Service Coverage Ratio (DSCR) is an important financial metric used to assess a business or individual’s ability to manage and service debt.

Debt Service Coverage Ratio, commonly abbreviated as DSCR, is an important financial metric used to assess a business or individual’s ability to manage and service debt.

It is also known by alternative names such as Debt Coverage Ratio and Debt-Service Ratio.

The primary objective of the DSCR is to provide a quantitative measure of the cash flow available to pay current debt obligations.

Essentially, it evaluates the financial cushion available to a company or individual to meet the debt repayment schedule.

DSCR Formula

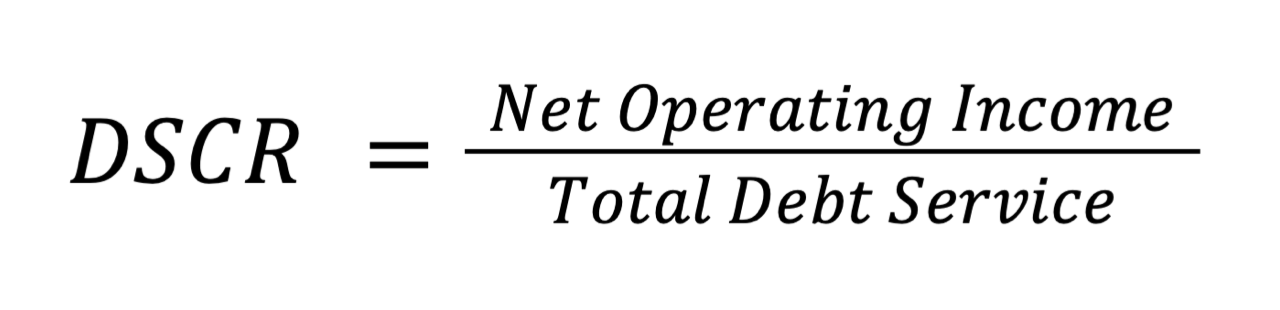

The formula to calculate the Debt Service Coverage Ratio is straightforward and is represented as follows:

Here, Net Operating Income refers to the income generated from the business operations, excluding any taxes and interest payments. It is often considered equal to earnings before interest and taxes (EBIT).

Total Debt Service includes all the company’s obligations related to debt repayment within a given time frame, usually a year.

This typically consists of principal repayments, interest payments, and any lease obligations that are due.

How to Calculate DSCR

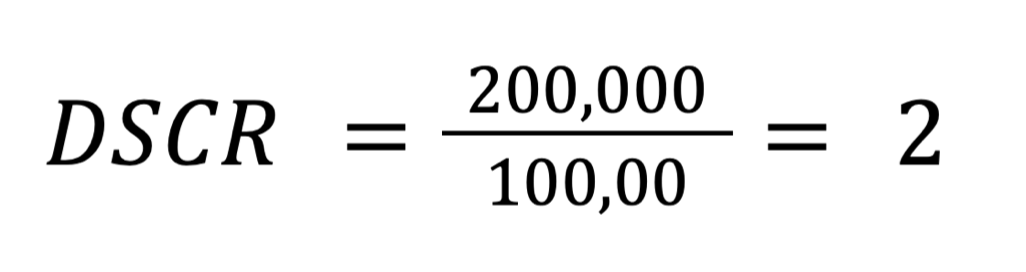

Let’s take an example to illustrate how DSCR is calculated.

Assume a business has a Net Operating Income of $200,000 for the year. During the same period, the business is obligated to repay loans amounting to a total of $100,000, which includes both principal and interest. Using the formula, the DSCR would be calculated as:

In this example, the DSCR of 2 signifies that the business generates twice the income needed to fulfill its current debt obligations.

Generally, a DSCR of greater than 1 is favorable as it indicates that the entity has adequate income to cover its debts.

Importance of DSCR

The Debt Service Coverage Ratio is critical in financial analysis and decision-making for businesses and lenders.

For a company seeking to expand through external financing, a higher DSCR can make it easier to secure loans and may even result in favorable interest rates.

Lenders view a higher DSCR as a lower-risk proposition, indicating robust cash flow and a comfortable margin to absorb any financial downturns. Generally, they would look for a minimum DSCR between 1.2 and 1.25.

| Read more: 6 SBA Alternatives You Should Know About |

If you want to apply for an SBA loan, you probably need a DSCR in that range or higher.

DSCR is not only vital for loan approvals but also for ongoing financial planning within a company.

It serves as an internal check for financial managers to gauge the ability of the company to meet future obligations, thereby influencing decisions related to further borrowing, investments, and growth strategies.

Moreover, variations in DSCR can indicate changing financial health, requiring adjustments to financial strategies or operations.

A consistently declining DSCR might necessitate cost-cutting measures, while an increasing ratio could provide the confidence to invest in growth-oriented projects.

What’s the Ideal DSCR Range?

Regarding the Debt Service Coverage Ratio, a ratio of 1.25 or higher is considered ideal. This means that the business or individual generates at least 1.25 times the income needed to cover all debt payments, creating a financial buffer.

A higher DSCR is preferred because it represents strong financial health, less risk for lenders, and a greater ability for the company to withstand economic downturns.

A DSCR of 2 would generally be considered very strong.

In Aquira’s experience, a DSCR of 1.6 is very good. If an acquisition entrepreneur does some preliminary calculations and finds a deal that will put them in that range (or higher) once they purchase the business, they are strongly advised to contact the seller immediately to start the negotiation.

Any entrepreneur who finds a business for sale that has this ratio should reach out to a seller immediately to move further along in the acquisition process.

A DSCR less than 1 is generally a red flag.

A small business with a high DSCR may decide it’s a good time to invest in new equipment or expand operations.

A low DSCR, on the other hand, might prompt the company to focus on boosting sales or cutting costs rather than taking on additional debt.

| Note: The SBA sets a floor for an acceptable DSCR at 1.15x, but it’s exceedingly rare to find a lender that goes below 1.25x. |

Factors Affecting DSCR

Several factors influence the Debt Service Coverage Ratio:

- Operating Income: The income generated from the business operations directly affects DSCR. A successful contract or increased service demand for a roofing company would increase income, thereby improving the DSCR.

- Total Debt Service: This includes all debts the business must pay within a given period, such as loan repayments and interest. The higher the debt, the lower the DSCR.

- Loan Terms and Interest Rates: Longer loan terms and lower interest rates can also help improve DSCR by reducing the monthly or annual debt payments.

- Economic Conditions: External factors like market demand, competition, and economic cycles can also affect a business’s operating income and hence its DSCR.

Tips for Improving DSCR

Improving the Debt Service Coverage Ratio can make a significant impact on a business’s financial stability and growth prospects:

Increasing Revenue

There are several ways to increase revenue, from price optimization to seasonal promotions.

For a roofing company, an entrepreneur could expand the range of services offered to include related areas like gutter installation or repairs, insulation services, or even solar panel installations. This increases revenue streams and makes the business less dependent on a single service line.

Another option would be to reassess the pricing strategy.

Sometimes, even a modest increase in pricing, if justified by quality and demand, can significantly boost revenues without affecting customer loyalty.

A roofing company could also offer special promotions during peak season (if they have the capacity for more work) or shoulder seasons to boost demand during historically slow periods. Discounted packages can attract more customers, and the increased volume can offset the reduced profit margins per job.

Reducing Expenses

One of the significant costs for a roofing company comes from materials. Negotiating better terms with suppliers or buying bulk can lead to substantial savings.

Adopting modern technology like project management software can help streamline operations, reduce manual errors, and reduce administrative costs.

Reducing energy costs by implementing energy-efficient solutions in your operations, such as energy-efficient vehicles or equipment, can contribute to lowering expenses over time.

Refinancing Debt

Combining multiple loans into a single loan with a lower interest rate or longer term can lower your monthly obligations, thus improving the Debt Service Coverage Ratio.

Sometimes, simply negotiating the terms of your existing loans can result in more favorable conditions. Lenders might be willing to adjust the terms if they see that your business is generally reliable but going through a temporary rough patch.

If you have a loan with a variable interest rate and market conditions are such that interest rates are rising, consider refinancing to a fixed-rate loan to lock in current rates and stabilize your debt service payments.

FAQs

Yes, a higher Debt Service Coverage Ratio is typically good. It indicates that a business or individual has more than enough income to cover debt payments, reducing the risk of default. This can lead to better loan terms and a stronger financial standing.

A high DSCR could result from a combination of factors like increased revenue, decreased expenses, or both. It signifies strong operational efficiency and financial management, allowing the entity more freedom to invest, save, or withstand economic downturns.

The Interest Coverage Ratio focuses solely on a company’s ability to cover interest payments with its operating income, ignoring principal repayments. DSCR, on the other hand, considers both interest and principal payments, providing a more comprehensive view of debt management.

The frequency with which you should check your DSCR depends on various factors like the nature of your business and its financial stability. However, it’s generally good practice to calculate it quarterly, or at least annually, as part of a regular financial review.

Conclusion

The Debt Service Coverage Ratio reflects your financial health and is a decisive factor that lenders consider when assessing loan applications.

With a firm grasp of what DSCR means, how it’s calculated, and how to improve it, you can make more informed decisions that affect the fiscal well-being of your business or personal finances.

Whether you’re looking to secure a new loan, manage existing debt, or assess the viability of a new business venture, the Debt Service Coverage Ratio offers critical insights that can guide your decision-making process.

Regularly monitoring this metric and implementing strategies to improve it set the stage for financial stability and open the door to potential growth opportunities.

Want to learn more about DSCR? Consider joining a growing cadre of acquisition entrepreneurs by enrolling in Acquira’s Accelerator program. We’ll give you the knowledge and skills to buy and operate a $1MM/year cash-flowing business.

Sign up using the form below, but space is limited!

Key Takeaways

- DSCR is a critical financial metric measuring an entity’s ability to cover debt obligations.

- A DSCR greater than 1 is generally favorable, indicating adequate income to service debt, while a DSCR less than 1 is a red flag.

- The DSCR formula is straightforward: the Net Operating Income is divided by the Total Debt Service.

- Lenders typically look for a DSCR between 1.2 and 1.25, considering it a lower-risk proposition, which could lead to favorable loan terms.

- Regularly monitoring and actively working to improve your DSCR can provide better loan conditions and open doors for financial growth opportunities.

Acquira specializes in seamless business succession and acquisition. We guide entrepreneurs in acquiring businesses and investing in their growth and success. Our focus is on creating a lasting, positive impact for owners, employees, and the community through each transition.