- Why company size is so important in business acquisition

- How to use Acquira’s SBA Model Calculator to model out different deal structures

- How Acquira’s equity fund can help you close on safer deals

When acquiring a business, your investment thesis is one of the most powerful tools you will have.

An investment thesis is a set of rules that defines what you will and won't invest in. In terms of acquisition entrepreneurship, a properly defined investment thesis will ensure you know what type of business to look for and where to look for it.

This facet of your business search is so important that we spend much time on it in our training. There are 18 lessons in our Accelerator Program that will help you fine-tune your unique investment thesis. First, we teach you how to define your geographical search. Then, we walk you through determining which industries to look at. Finally, we talk about the size of the deal you should pursue.

Many people overlook this last aspect of the process. We've seen many Acquisition Entrepreneurs (AEs) often suffer when buying businesses that are either too small or too big.

This article will take you through some of the training we use to help AEs define the size of the business they will look at.

First, you'll need to familiarize yourself with our proprietary SBA model calculator. Please make a copy of this and review the Instructions sheet, which also links to a video overview that walks you through the model.

Generally, the SBA likes to lend up to 80% of the purchase price. The other 20% will come from a combination of equity (your cash, at least 5% of the purchase price) and seller financing. This could be 5% equity and 15% seller financing, 20% equity and 0% seller financing, or anything in between. Your first constraint is the amount of equity you can contribute. For the examples in this module, let's assume the amount is $160,000.

We will walk you through a few different deal sizes and structures and see how much free cash flow you have left over after paying your debt each year.

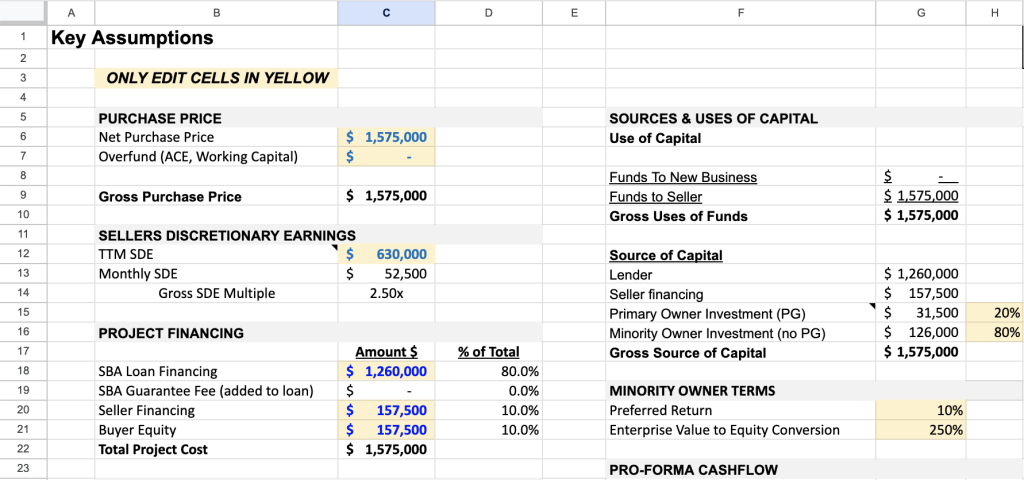

Pay close attention to the “Post-Debt Cash Flow” in cell C49. This is the business's stated SDE minus the projected principal and interest payments you must make. As a rule of thumb, we want to see this number higher than $400,000.

Why $400k?

When you buy a business, the first two years will be the most challenging time. There are several issues many new business owners face, including:

- A steep learning curve

- Difficulty forging relationships with employees and customers

- Revenues decline

- A key customer leaves

- A key employee leaves

- An unforeseeable considerable capital expense

- They get overwhelmed and have to hire another key manager

After this initial period, you will likely succeed as you will be a significantly upgraded version of yourself. So we recommend optimizing for de-risking this period, and buying a business with more post-debt service cash flow is the best way.

$400k gives you a safety net for a couple of the above risks while leaving sufficient cash flow to pay yourself a fair market salary for your work (typically $150k/year with benefits) – and make your debt service payments. If you have so little left that you have to skimp on your salary, you risk imperiling your company because you need to take on outside work.

Note that this amount must increase if you want to replace a larger salary. If you currently make $250k per year and want to replace that salary, you should up the “Post-Debt Cash Flow” requirement in cell C49 to $500,000.

The “Sweet Spot” Multiple

Let's take a moment to talk about starting multiples.

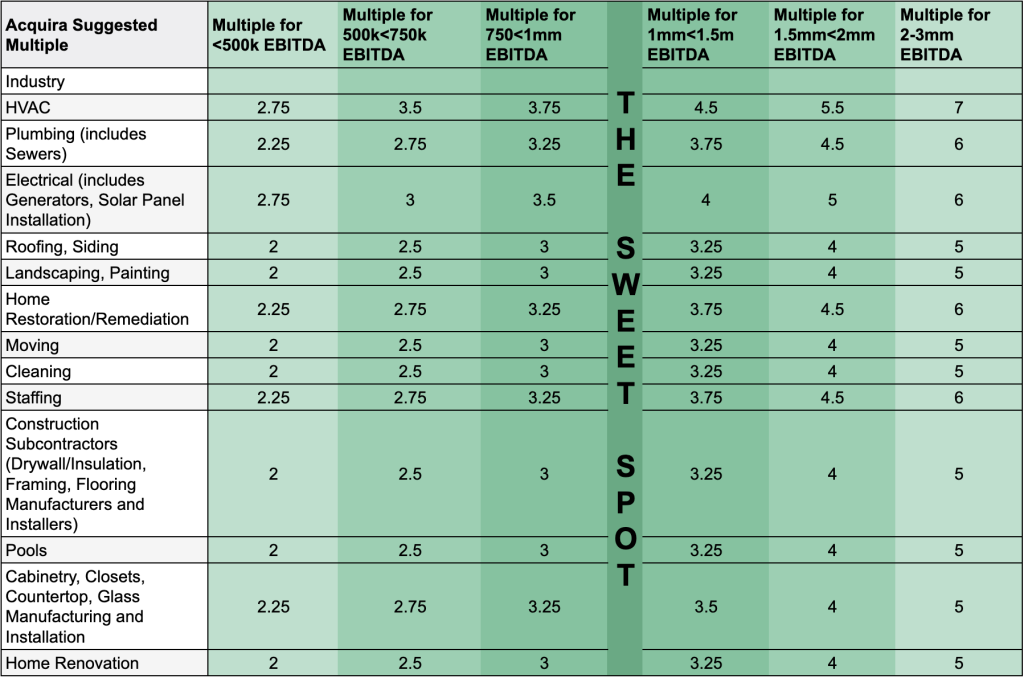

There are hundreds of different industries – most of which you probably haven't thought about (i.e., electron tube manufacturing or drive-in movie theaters). However, only a limited number of Acquira have experience and interest. We concentrate our attention on the home services space.

Acquira's expertise is in these industries, and we are interested in co-investing with AEs in businesses that meet our criteria. Note that some of them may be segmented into retail and commercial components. We're also interested in these types of businesses, even though they're not solely home services.

Thanks to our experience in these corners of the economy, we are familiar with common starting multiples across different industries based on the company's EBITDA multiple.

| EBITDA: Earnings Before Interest, Taxes, Depreciation, and Amortization. |

We've also noticed a sweet spot valuation broken down in the chart below.

This is covered in greater detail in the industry analysis section of our Accelerator Program. To learn more about the program or determine eligibility, fill out the form below.

Modeling A Few Scenarios

Now that we understand starting multiples, let's make another copy of our SBA model calculator and play with different business sizes.

Try putting in a $630k SDE business with a $1.575mm purchase price (2.5x), with the standard 10% equity, 10% seller financing, and 80% SBA loan (for simplicity's sake, make the overfund $0). The “Post-Debt Cash Flow” in cell C49 comes to just about $400k.

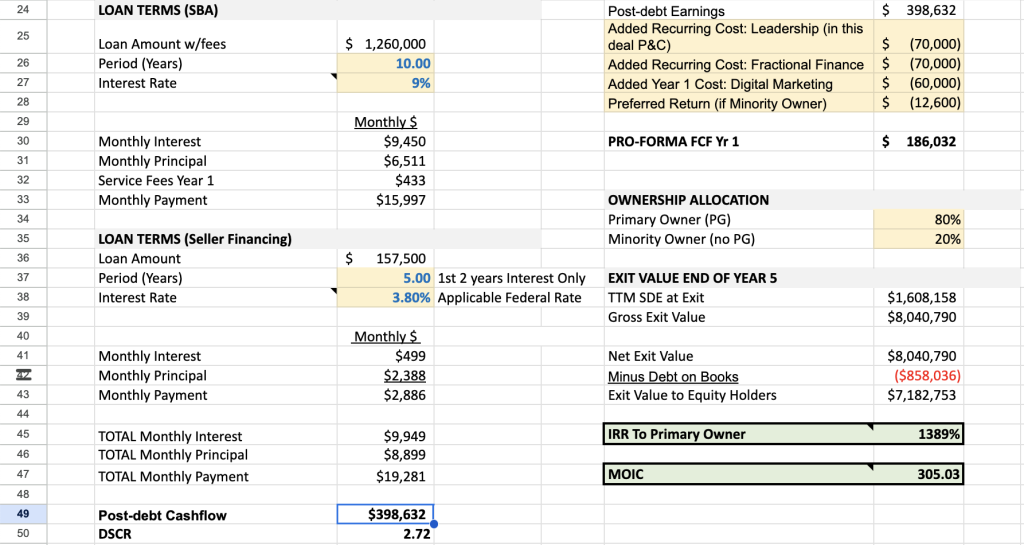

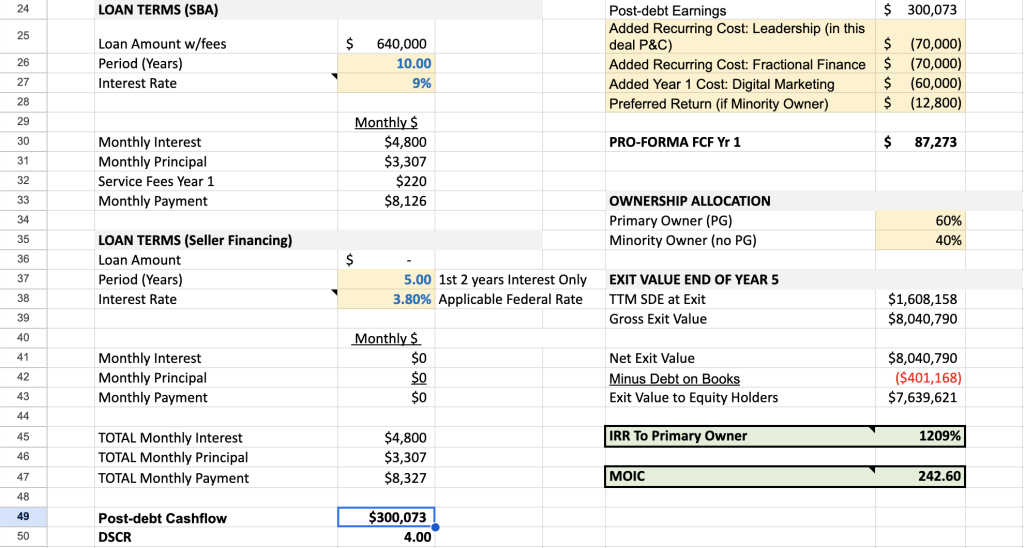

Now try putting in a $400k SDE business with an $800k purchase price (2x), but with 20% equity, 0% seller financing, and 80% SBA loan (for simplicity's sake, make the overfund $0). You are making $300k in post-debt cash flow for the same downpayment as the option above.

The returns are much higher overall, but you're taking more risk, primarily because the smaller a business' SDE, the less depth it has from both an employee and customer perspective, and the more likely one of these risks are to occur.

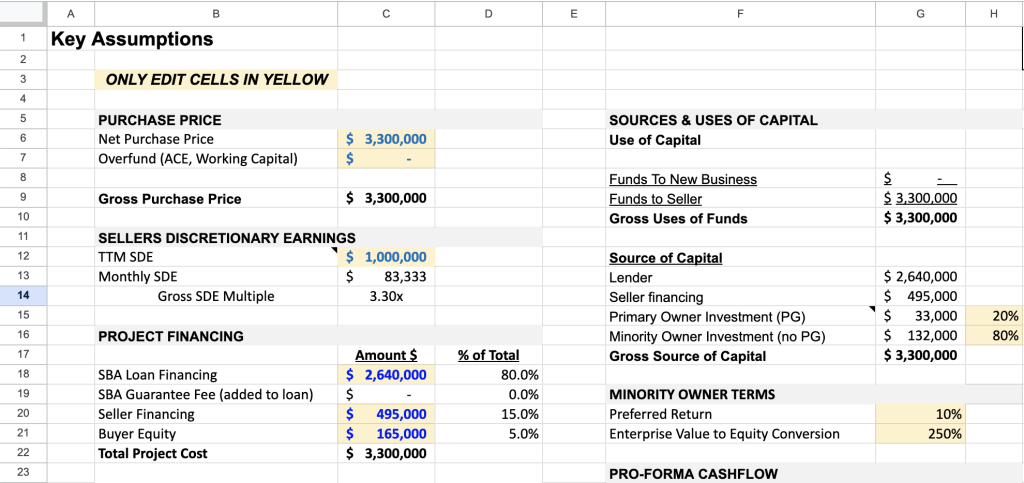

Finally, make another copy with a $1mm SDE and a $3.3mm purchase price (3.3x), with 5% equity, 15% seller financing, and 80% SBA loan (for simplicity's sake, make the overfund $0).

Despite the higher multiple, you are making $479k in post-debt free cash flow on the same $160k in equity down.

Also, this larger business likely has around $5mm in top-line revenue. A large business's current seller/owner/operator is probably not doing any technical work, making the transition less risky.

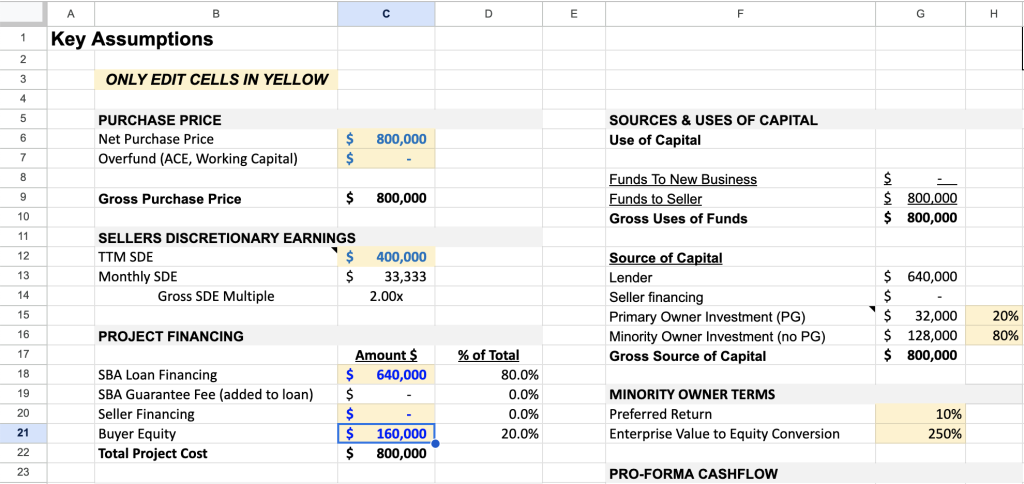

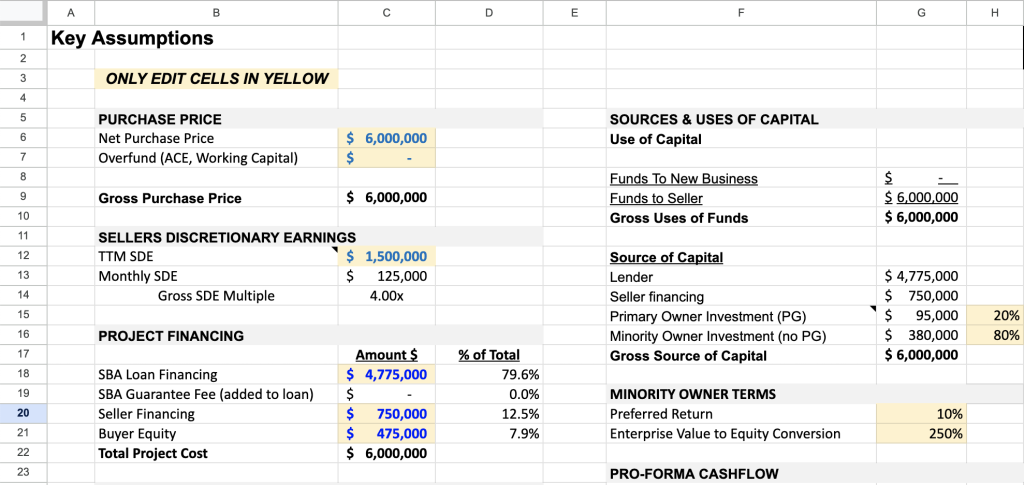

The Equity Fund

Acquira also has an equity fund that invests in AEs and their businesses. It typically covers up to 80% of the equity required to purchase a business. In exchange, it gets a 10% preferred return on the amount invested, and each dollar it invests gives $2.5 worth of ownership. The previous examples assumed you were putting your $160k down to own 100% of the company. But what if you wanted to buy a larger business? Let's make another copy and explore.

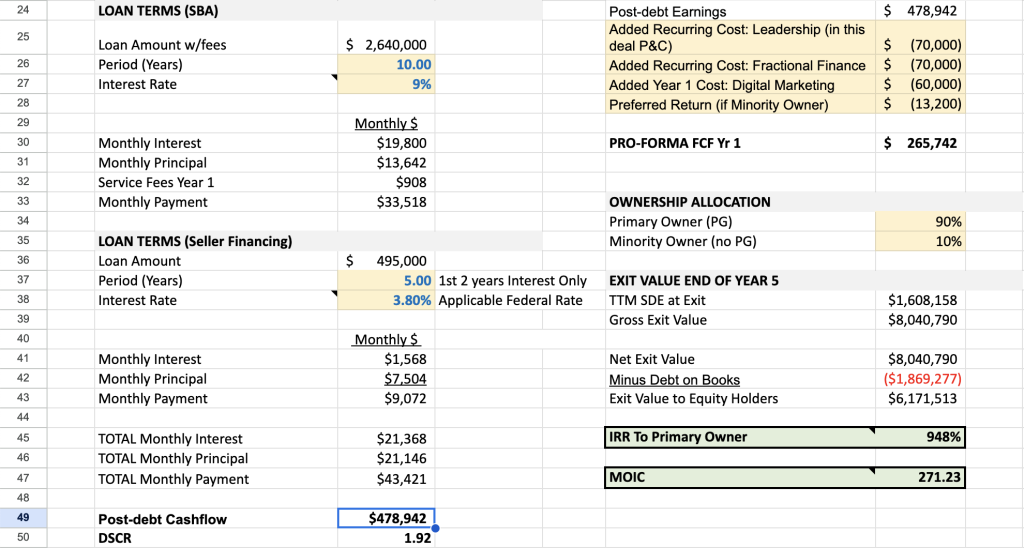

We'll use 1.5mm SDE with a purchase price of $6mm (4x). Again, a business of this size is likely de-risked because it has more depth and is more management-run. It's very rare to get to 1.5mm SDE without those elements.

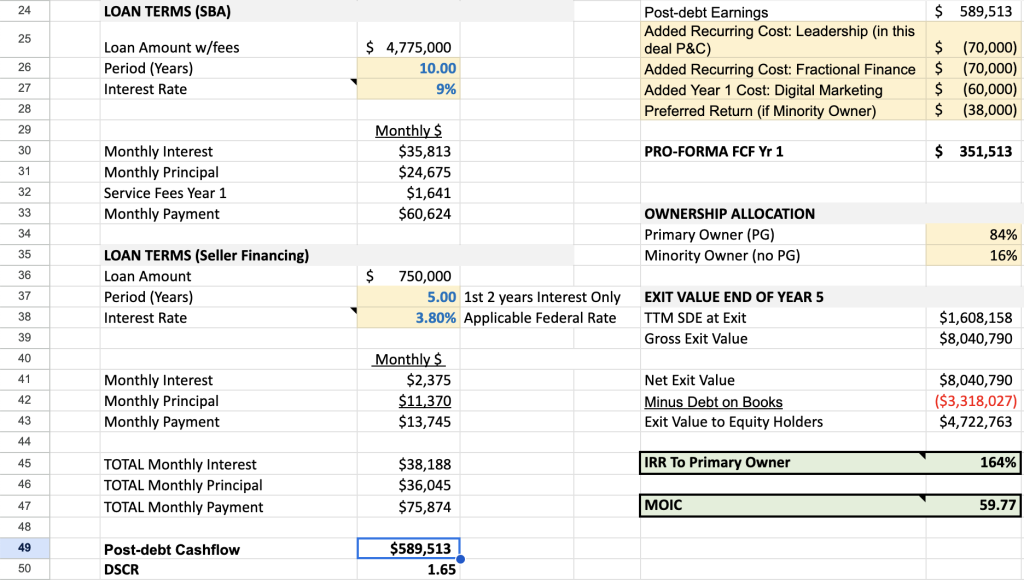

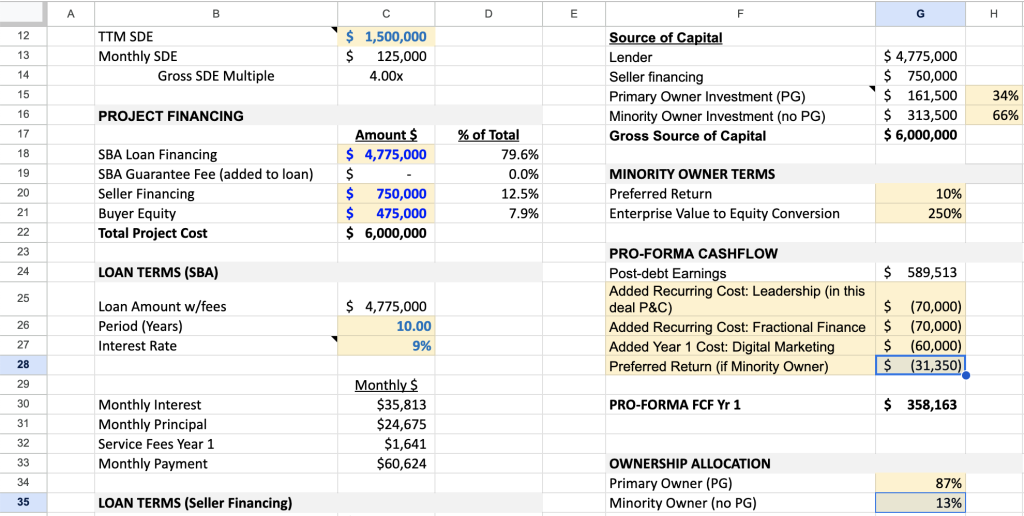

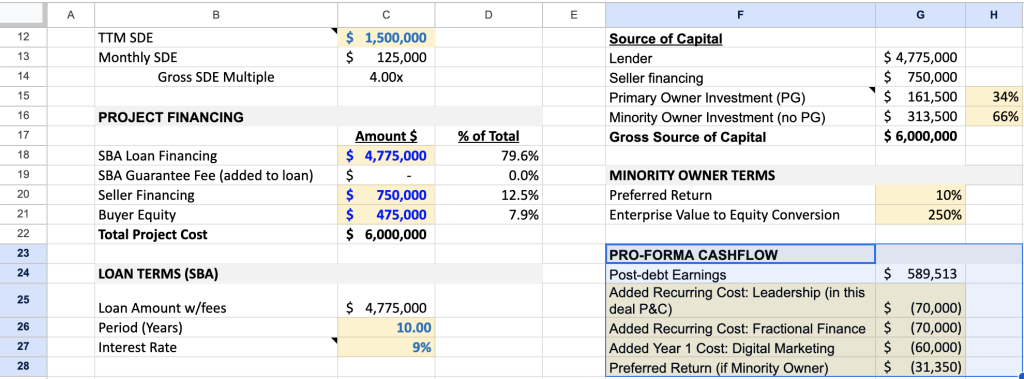

Your SBA maximum is just over $5mm, so let's work with that constraint in the terms of this offer. Let's put $750k in seller financing (12.2%), $475k in buyer equity (7.8%), and the remaining 80% in an SBA loan ($4.775mm). You'll see the post-debt cash flow is a very healthy $589,513.

Now update H15 to 34%, as that is $161,500 in equity you'd be putting up. Then, edit H16 to 66%, as the equity fund would put up $313,500. You'll see the ownership allocation in G34 and G35 immediately updated. You are giving up 13% of the equity.

You'll also see the preferred return in G28 show up as an added expense for the business of $31,350 per year – this is an amount you pay out to the equity fund before you can issue dividends. It differs from debt in that it only needs to be paid out if you issue dividends.

So, assuming you were to issue dividends with your free cash flow of $589,513 – you'd first pay the $31,350 to the equity fund, and then the remaining $558,163 would be distributed 87% to you ($485,602), and 13% to the equity fund. Including the $150k salary you are taking (which is already being considered in the SDE of the business), your take-home would be $635,602.

Pro Forma Financial Statements

When reviewing businesses or applying for SBA loans, pro forma financial statements are necessary.

Pro forma statements predict future financial outcomes based on expected investments in change. Typically, you'll consider two eventualities: the financial statements if things go as planned and the downside financial statements. Of course, things could always go better than expected. But you hardly need to plan early for this.

You can do fundamental modeling of this in the same SBA Model calculator in cells G25:G27.

These represent added costs in year 1 to help systematize the business (that would sit outside of the Overfund amount in C7). Most businesses would benefit from adding 100k to 200k in expenses – the exact amount would depend on the deal and the Acquisition Entrepreneur. For example, a deal where the transitioning owner handled the finances, and the AE does not have strong financial skills, would likely benefit from a fractional CFO for financial leadership.

Most businesses do not have a strong web presence or any form of digital marketing or advertising. So, we model an added cost of $5k/month ($60,000) for this.

More detailed pro-forma expenses are added in the “Cash flow model – 5-year exit” sheet, with instructions within the instructions tab.

Why not use the pro forma FCF number in cell G30 as our cash flow constraint?

This is a number for expenses added in year 1. If these expenses don't correspond with growth to your gross profit, they will be removed by year 2. This is also why we like to have a decent portion of the deal financed by the seller and to not include principal payments in the first 1-2 years – it preserves your cash flow while you are testing growth initiatives.

Conclusion

The point of this exercise is to show that it is often safer to acquire a larger business. By investing more in a higher-valued company, you de-risk your investment and increase your take-home pay.

Not everyone can put up the cash to buy a larger business. That's where Acquira's equity fund comes in. The equity fund can help AEs buy larger, safer businesses.

Acquiring a business takes time, hard work, and dedication. Knowing what to look for and how to look for it will decrease the time and make the work slightly more accessible, allowing you to dedicate attention to other aspects of the business buying process.

A well-crafted investment thesis is a tool that will show you what to look for and how to look for it. However, the business size is a crucial aspect of that tool that is often overlooked. Knowing what size business to buy will yield positive financial and operational results in the difficult first few years of business ownership and beyond.

We laid out above an example of one module of Acquira's training. Creating your investment thesis comprises 18 lessons, but there are many more lessons and hundreds of hours of informative videos and other materials to go through.

If you'd like to learn more about Acquira's Accelerator Program and how we can help you buy a business, fill out the form below.

Key Takeaways

- Your investment thesis is one of the most important tools you'll use on your business buying journey.

- Do not overlook “business size” when crafting your investment thesis.

- Buying a larger business is often a better investment.

- Acquira's equity fund was built to help AEs close on these deals.

Acquira specializes in seamless business succession and acquisition. We guide entrepreneurs in acquiring businesses and investing in their growth and success. Our focus is on creating a lasting, positive impact for owners, employees, and the community through each transition.