- How to determine your own risk tolerance.

- How Acquira trains Acquisition Entrepreneurs to vet deals.

- How to create your own investment thesis.

- What factors Acquira uses to weigh risks in potential acquisitions and why.

- Why easy-to-scale growth opportunities should not be your only consideration.

Business acquisitions can be an exciting thing.

There are often large sums of money at play; negotiations can get heated, and a lot is at stake.

But if you're not careful, you can get swept up in the excitement and end up with a bad deal.

The best protection against this is a well-defined investment thesis. An investment thesis allows you to lay out your risk tolerance to quickly and efficiently disqualify bad deals or identify good deals.

An investment thesis can be built around several criteria, including geographic scope, industry, brand moat, company culture, etc. Whatever criteria you use, the thesis will help to remove subjective opinions and emotions from the analysis of a deal, as well as quickly screen opportunities and separate the signal from the noise.

Even though it is essential, many Acquisition Entrepreneurs will skip this step due to their eagerness to get started – or ignore it entirely.

This eagerness can lead people to make bad decisions and buy bad companies. In this article, we'll go into how you can define your risk tolerance and what factors you can use to analyze deals; plus, we'll share a cautionary tale from our own acquisition experiences.

Determining Your Risk Tolerance

Without risk, there is no reward. But you need to know exactly how much trouble you're willing to take because it won't be the same for everyone.

As the US Securities & Exchange Commission states on its website:

“Regarding investing, risk and reward go hand in hand. The phrase “no pain, no gain” – comes close to summing up the relationship between risk and reward. Don't let anyone tell you otherwise: all investments involve some degree of risk.”

While the SEC is speaking specifically about securities, they correctly point out that a degree of risk is involved in all investments.

Before looking into potential acquisition targets, you must define your risk tolerance.

Generally speaking, those with a high risk tolerance are willing to risk losing money for potentially greater results. Investors with a low risk tolerance favor investments that maintain their original investment.

Here are some questions you can ask yourself to help determine your own risk tolerance level:

1. What are your Investment Goals?

People invest in securities for many reasons. People who invest in small businesses are often looking for something more specific.

At Acquira, we believe that small businesses will become the next trillion-dollar asset class, largely driven by acquisition entrepreneurs (AEs) looking for financial freedom, independence, and the opportunity to create generational wealth.

Other AEs are merely looking for something to help them earn money for their retirement or their children's education.

Deciding your goals is the first step to determining your personal risk threshold.

2. What is your Time Horizon?

Once you know your investment goals, it becomes easier to establish the time horizon for your investment. Your time horizon is when you plan to use your invested money. In the world of small business acquisitions, this can be thought of as your exit.

Exiting from the company amounts to cashing in on all the hard work you've put into the business during your time as the owner. Acquira offers AEs an exit path by issuing a warrant on the companies they acquire, ensuring the opportunity for the AE to sell the business for more than what they paid.

The timeline for this is multiple years. However, the time horizon can shrink significantly if you can systematize the business and change it from owner-operated to management-run by installing a leadership team. (Which members of our Accelerator Program are trained to do as part of our ACE Framework.)

We talked about how different time horizons might look for different career paths in our Third Path video:

3. How Comfortable are you with Short-Term Loss?

Nearly every investment will experience short-term losses at some point. There will be a market correction or recession, and investments will dip. [Incidentally, Acquira recommends recession-resilient businesses like home services companies.]

In the world of business acquisition, there are additional reasons you may experience short-term loss. As we mentioned above, systematization and creating a leadership team are the best ways to speed up your exit from the business, but implementing those takes time and money, which can result in a temporary dip in gross profits for the company.

Given the goals and time horizon you set, can you stomach a loss in the short term? This can be unnerving for some Acquisition Entrepreneurs.

4. Do you have any Non-Invested Savings?

If you're dumping every penny you have into buying a business, you may want to rethink your strategy. At the very least, you should consider buying a smaller company. Even the best laid plans can meet with ruin, so ensuring a financial safety net is always recommended.

The size of that safety net will help you determine your risk tolerance. Generally speaking, those with more to fall back on can take greater risks than those without much in the bank.

Flagging Risk

Once you've determined your risk tolerance, you need a system to quickly identify any deal-killers in a potential acquisition. In Acquira's training, we teach AEs to use our Deal Flagging System. When analyzing a business, you'll come across items that will cause varying degrees of concern. You need to weigh those concerns against your risk tolerance, and that's where the flag system comes in:

A Green Flag: There are no issues with a particular item.

A Yellow Flag: There is a small issue that needs to be monitored, but it isn't anything to be alarmed over.

A Red Flag: There is an alarming issue, but it could be mitigated with a certain amount of negotiation or planning.

A Black Flag: The Deal Killer. This issue indicates the business doesn't fit your investment thesis and can't be fixed no matter what you do.

Three yellow flags constitute a red flag, and three red flags make a black flag.

By determining your risk tolerance and understanding how to flag specific items, you can quickly determine whether a deal is outside your comfort zone. Of course, the scoring system outlined above is based on personal opinions, and we like to look at the data here at Acquira. In the next section, we'll explore the exact points we weigh to determine whether a deal is too risky or offers some hidden value.

Creating Your Investment Thesis

Your investment thesis acts as a checklist of required criteria to do a deal based on the terms of that deal. For example, Acquira's investment thesis for any deal that we might invest in would require the following criteria to be met:

- The business has existed for at least 5 years

- The business is doing at least 500k in annual SDE (Seller Discretionary Earnings) – Smaller businesses don't have as much room to invest in growth and still provide a yield

- There is a diverse customer base (no large customer concentration)

- Has a large enough serviceable market so that if you hit a home run on carving out market share through digital marketing, you can at least 5x the business

- The team has a strong culture of having each other's backs

As long as the business fits the above, we will consider it. We analyze the deal based on the following factors (we'll go further into detail on these factors in the next section of this article):

- Company Culture

- Industry and Company Moat

- Demographics and Industry Dynamics

- Pricing and Margin Health

- SDE Trend

- Seasonality

- Customer/Sales Concentration

- Key-Man / License Holder Risk

- Recession Resilience

- Management Depth

- Operations Sophistication

- Acquisition Entrepreneur Fit

To define your investment thesis, you can ask yourself the following questions:

- How flexible are you as to the location of the business? Which cities or states?

- How much time can you spend physically at the business in the first 6 months?

- What additional items would you add to the screening criteria?

- What industries are you most interested in buying a business in?

- How much cash must be distributed to yourself per year for the first three years?

- If you had to remove only one of the ten screening criteria, which would it be?

- If you had to keep only three screening criteria, which would they be?

How To Weigh Acquisition Risks?

Acquira's training is an entrance-to-exit program designed to find and close a business for you within seven months, integrate our ACE Framework within the following nine months, and exit the business to earn more than what you paid for the business.

It includes in-depth analysis, case studies of real business acquisitions, and various proprietary tools to help you in the business search process – including an Intrinsic Value Calculator.

The calculator is designed to help you appraise businesses relatively quickly. We do this by weighing ten different risk factors that we have identified as important enough to impact the value of a business.

With the calculator, we teach you how to measure each item, then give you a suggested formula to adjust the multiple based on your measurement. This spits out a final internal value price. You've found a good deal if that price is above the asking price.

As Warren Buffet said, “Better to buy a wonderful company for a fair price than a fair company for a wonderful price.”

The factors are weighted so that, depending on their score, they will raise or lower the value of a business. First, there are two important terms to lay out:

- The asking price: This is, quite simply, how much the seller asks for the business. It is usually based on a multiple of the company's SDE (Seller's Discretionary Earnings) or EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). So, if a seller asks for $1 million, and the business is valued at 2.5x, its SDE is $400,000.

2. The internal price: This is what the buyer values the company at based on their due diligence findings. The internal price should not impact the asking price. If, after conducting due diligence research on a business, you find that its internal price is higher than its asking price, then you have found a good deal.

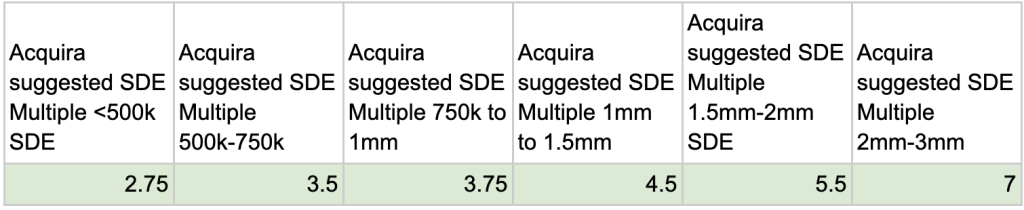

The Intrinsic Value Calculator takes a business' SDE and begins with a starting multiple. This multiple is different for each industry, and we have a matrix of multiples based on 6 EBITDA ranges and 15 industries that we actively buy in:

So, for example, if the company's SDE is $600,000, the starting multiple for a business of that size is 3.5, which means the purchase price would be $2.1 million in total. If you were to finance the payment for that business through an SBA loan, you might pay $210,000 of your own money. The calculator provides a range of valuations based on company size.

The AE then runs through the weighting factors that will raise or lower that multiple. We've laid this out in past articles, but it bears repeating. The factors we look at include:

1. Company Culture

We're looking for whether employees are engaged and enjoy working there. The best way to test for this is to try for the opposite – disengaged, disgruntled employees tend to quit or be laid off.

To discern the health of a company's culture, we look at the average tenure of employees by department. If the average is under three years, that can lower a company's multiple; if it's higher than six years, that can raise the multiple.

We also look at health benefits offered compared to the local average. Specifically, if the benefits package is well below the industry average, that can lower a company's multiple.

There may be instances where you would limit this appraisal to the amount of turnover by segment. For example, you may want to confine your analysis to the leadership team or technicians while excluding CSRs or warehouse workers. We've seen companies with good culture in the field but bad culture in the office.

2. Brand Moat

This looks at how long it would take to replace the business' review base/referral base (including word of mouth).

Put another way, if you were doing a startup competitor from scratch, how long would it take, and how much would it cost to recreate this business's brand/marketing strength?

A company scores lower if it takes less than two years to build its brand moat.

We are mainly looking at replacement costs. For context, building out a great web presence and at least 200 5-star reviews would cost about $100,000 and can be done in about a year for most businesses, where the average ticket is in the hundreds of dollars (longer for larger ticket items like roofs).

Note that you should also consider your skills, network, and assets as an acquisition entrepreneur.

3. Demographics

This is a combination of demographic growth (new people moving in over the next decade) and overall existing market share. To calculate the overall existing market share, we divide the total serviced households by the estimated total number of serviceable households.

We look at two things here:

1) What is the natural growth of this business if you don't take away market share from competitors?

2) What is the growth if you hit a home run and get 20% of your addressable market?

Investing in integration and digital marketing optimization will cause a small business to grow simply by sifting it away from its competitors. That means over five percent of a business's growth rate can NOT come from natural/organic/demographic growth.

4. Gross Profit Trend

Is the business' gross profit growing or stable? The gross profit trend should measure both margin and total dollars.

We measure this instead of revenue because different service or product offerings can often have drastically different contribution margins, and we measure it instead of EBITDA because we can control operating expenses post-close.

5. Seasonality

Is the business highly seasonal, meaning revenue or profitability varies depending on the month? This is important to understand the working capital needs of the business. Seasonality is often managed by furloughing the workforce or introducing new, non-seasonal products or services.

6. Customer/Sales/Vendor Concentration

If a single customer takes their business elsewhere, how much will that impact their bottom line?

This is important to measure from the perspective of both the economic user and the referring user. That's because, financially, it may seem like no single customer has more than 10 percent of your sales, but you may find that a single General Contractor is referring 25 percent of those customers to you.

Additionally, this is important to measure from a gross profit standpoint, as different work gets different margins.

7. Key Man / License Holder Risk

Are there any employees who are crucial to the business operations? If they left, could it stop the business from operating? For how long?

This could be based on an employee holding a key license, holding a key customer relationship, or being the only person in the company outside of the owner capable of doing a key job that is very difficult to replace.

8. Recession Resilience

How exposed to the overall economy is the business? This primarily impacts your down-side pro-forma financial model. We want to ensure that in the event of a recession, the owner can still make their debt payments and pay themselves a living wage. The living wage part is important; you don't want to be forced to return to the workplace and neglect your business.

We also include asset value in this part of the calculation because if it is high enough, it can override recession risk. If a business's furniture, fixtures, and equipment are a high percentage of its purchase price, your risk is lower as you can flip those assets in case of insolvency.

Banks are also aware of this and are more likely to approve you for a loan requiring less collateral (though this would be through a non-SBA loan).

You want to look at the likelihood of a recession impacting the business, as well as the impact a recession would have.

9. Management Depth

Introducing layers of management takes both time (opportunity cost) and risk (potential profit decline).

a) Mid-level Managers

Getting a manager to a point where they are trusted, capable, and confident is generally a six-month process. So, finding a business that already has this in place will allow you to accelerate your growth by six months. If the company's cultural health is poor, however, this could take up to a year (and the risk of alienating other employees is higher). You also risk promoting/hiring the wrong person and thus affecting the retention of the people they manage and their output.

b) Leadership

Building a leadership team within the company to the point where they are trusted, capable, and confident is typically a year-long process. So, finding a business that already has this in place will allow you to accelerate your growth by 12 months. If the company's cultural health is poor, however, this could take up to 18 months (and the risk of alienating other employees is higher). You also risk promoting/hiring the wrong person and thus affecting the retention of the people they manage and their output.

10. Operations Sophistication

Here, we measure how well the company uses technology and makes data-based goals and decisions. This is important as the owner will want to implement this in their business, and the process takes time and carries some risk.

Typically, it would be best if you didn't introduce large technology changes in the first six to 12 months post-close, as that can create friction. The business owner should strive to instill trust before making any sweeping changes.

If these technological tools are in place, growth could be accelerated. Note that you could implement them sooner, but the risk of alienating your team grows the faster you do it post-close.

Weighing all of these factors becomes easier with a tool like Acquira's Intrinsic Value Calculator, but of course, you can always come up with your weighting system. Just ensure you test it regularly and use it consistently to measure deals.

Better to buy a wonderful company for a fair price, than a fair company for a wonderful price.

– Warren Buffet

The goal of our calculator is to make life easier for deal searchers. Once you know how to measure each item and put it through the suggested formula, you can adjust the multiple based on your criteria. This will give you a final internal value price; if that price is above the asking price, you're golden.

How To Identify A Good Deal

Once you've defined your personal risk tolerance threshold and know how to weigh the risk factors of a business, you need to identify the good deals when you find them.

This happens during the due diligence process. After signing an NDA (non-disclosure agreement), you will receive a prospectus to go over. The prospectus will lay out the history of the business, its assets, its financials, and other facts.

Certain factors like company culture may be more difficult to discern from the prospectus. You must do two diligence passes of any business: one pre-LOI (letter of intent) and one post-LOI. The calculator will help you weigh the business based on the first and second pass criteria. As you gain more clarity on the business, how well the business matches your investment thesis will become more well-defined.

When you review a business prospectus, flagging any items that don't match your investment thesis or risk tolerance, is pre-LOI diligence.

The Intrinsic Value Calculator aims to find a business with a higher Internal Price than the asking price – these are the good deals.

If the business looks like a good deal after the first pass, matches your investment thesis, and doesn't surpass your risk tolerance, you can issue a Letter Of Intent (LOI). The LOI is a non-legally binding document that is integral to buying a small business. Once the LOI is issued, the seller will provide more information on the business, and the post-LOI diligence phase begins. This is a much more in-depth diligence process that involves in-person site visits to the company, one-on-ones with key employees, and a deeper financial analysis of the business. We lay out these steps in our Last Mile training.

Once you have the additional information on the business, you can run it through the Intrinsic Value Calculator for the second pass to see if the internal price rises more.

When there's a big variation to the upside between the internal price and the asking price, you've found a good deal.

Risks VS Low-Hanging Fruit: A Cautionary Tale

The strictest investment theses are only helpful if you stick to them, though, and it's not uncommon for Acquisition Entrepreneurs to get caught up in the excitement of the process and overlook red flags to acquire a company. Almost every time this happens, they end up making a bad deal. It happens time and again, and Acquira's leadership is no exception.

As the company's CEO Hayden Miyamoto explains, this exact situation happened with a previous business of his. It was 2016 when he was still relatively new to acquiring businesses, and his company specialized in acquiring online businesses. They already owned an existing business with a high referral program that netted them $220 per sign-up. They found a new site with a much smaller competitor, making just $120 per sign-up with the same referral partner. It was for sale at 2x its valuation.

“So we figured we could nearly double the income by combining the accounts,” explained Hayden. “But the new site was new, like a year old. And our investment thesis at the time was to only buy companies over three years old. But doubling it overnight, meaning we could make our money back in a year, was too appealing.”

According to Hayden, the site went under about two weeks after the purchase.

“It dropped to zero.”

Hayden and his partners were so attracted by the potentially easy revenue boost that they overlooked a key component of their investment thesis: don't buy anything younger than three years old. They forgot the wisdom of Mr. Buffet that it's “better to buy a wonderful company for a fair price than a fair company for a wonderful price.”

When analyzing a potential business acquisition, you'll often come across aspects of a business operation that could easily be made better, improving efficiencies and boosting profits. These easy-to-scale growth items are what we think of as low-hanging fruit.

Depending on the business, some examples might include:

- Local optimization (Google Local, HomeAdvisors, Yelp, Angieslist, etc.)

- Revamping the website and improving conversions and tracking

- Digital Advertising (SEO, Adwords, Facebook)

- Testing pricing and value proposition remodels

- Referral marketing programs

- Marketing to existing customers

- Onboarding an external call and e-mail center for emergency calls, lead responses, etc. (for better response time)

- Tracking lead-response times and bringing this down to under 1 hour

- Optimizing copy and scripts for calls and emails

Don't let the profit potential from this low-hanging fruit override any aspect of your investment thesis.

However, once you have acquired a company and identified those easy wins, taking advantage of those opportunities should be the first step to growing the company. This will create the fastest results and help instill trust in your new employees as they see you make positive changes.

Conclusion

Business acquisitions can be very exciting. It's easy to let low-hanging fruit opportunities make you forget about carefully considered aspects of your investment thesis – but don't do it!

Risk is inherent in any investment, but the best tool you have to mitigate that risk is a well-thought-out investment thesis. The thesis allows you to scrutinize potential deals quickly, disqualifying bad deals or identifying good ones.

This process is the best way to find any diamonds in the rough – but to accomplish that, you must first know your risk tolerance and how to weigh the risk factors before you can identify a good deal.

Acquira's training was explicitly designed to teach people this process. Our Accelerator Program is a stem-to-stern, entrance-to-exit business acquisition program that will train you to source and vet a business, walk you through the negotiation and closing processes, provide post-acquisition growth, and offer you a potential exit for more than what you initially paid.

The first step is to schedule a call with one of our representatives through the form below. Someone will be in touch within 24 hours.

Do you have any instances where the potential for a quick payoff overrode a carefully considered strategy? Let us know in the comments below.

Key Takeaways

- Risk is an intrinsic part of any investment.

- The best tool to mitigate risk is a strong and well-thought-out investment thesis.

- To create your investment thesis, you must first understand your risk tolerance.

- Define what your investment goals are and your time horizon.

- Don't let low-hanging fruit opportunities override aspects of your investment thesis.

Acquira specializes in seamless business succession and acquisition. We guide entrepreneurs in acquiring businesses and investing in their growth and success. Our focus is on creating a lasting, positive impact for owners, employees, and the community through each transition.