- Why HVAC companies make good acquisition targets.

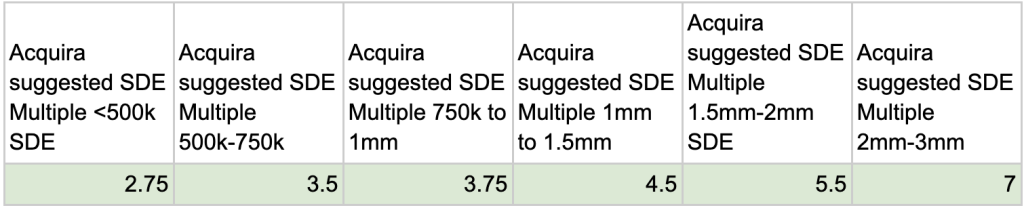

- The starting multiples for HVAC companies based on SDE.

- The difference between commercial and residential HVAC companies.

- Why HVAC companies that specialize in service are preferable to those that specialize in construction.

- What considerations might raise the price of an HVAC business.

- What factors might lower the price of an HVAC business.

There isn’t much that is certain in life, but there are always a few things you can count on: temperatures change, winds blow, and people want to be comfortable.

HVAC companies make good business sense for all of these reasons and more. Indeed, the U.S. HVAC services market is predicted to increase in value from $25.6 billion in 2019 to $35.8 billion in 2030.

But building something from the ground up takes years of hard work. That’s why many people are turning to acquisition entrepreneurship to help skip over some of the bumps on the road to business success. Acquiring an existing business is still one of the fastest ways to create wealth and freedom in the modern economy.

Acquira itself has a history of acquiring and running HVAC businesses around the United States, and we’ve learned a lot from our experiences. If you'd like to learn more about our experience and how we can help you find and buy your own HVAC company, simply fill out the form below.

In this article, we’ll dig into why HVAC companies make such good business acquisition sense and what factors to consider when looking at a potential deal.

What is an HVAC Company?

Before we dig in deeper, it’s important to understand the business model of these companies. “HVAC” stands for “Heating, Ventilation, and Air Conditioning.” You’ll sometimes see it written as HVAC/R, including “Refrigeration.”

HVAC technicians (and the companies they work for) install, regulate, and maintain those systems that handle the climate control systems in a home that move heated or cooled air throughout the building to maintain a comfortable temperature for the inhabitants.

Many HVAC contractors also offer duct cleaning or maintenance and repair for boilers or other water-based heating systems. While boilers differ from HVAC systems, many HVAC techs are trained in both areas.

What Makes HVAC Companies Good Acquisition Targets?

We’re generally very bullish on home services and HVAC businesses. As mentioned, emergency repairs make up much of an HVAC company's work.

The average person can’t do that work independently and is willing to pay for it, even when it comes at an inconvenient time. That brings us to our first point:

1. Recession Resilient

Even when the economy hits hard times, people will still need to fix their heating when it breaks. After all, most homeowners aren’t well-versed in the inner workings of their heating and ventilation systems, so they call in the experts when something breaks.

There’s also the matter that during economically difficult times, most people aren’t looking to buy new homes, opting instead to make the home they have more comfortable. That could mean a new air conditioner or heating system.

Because of factors like these, HVAC companies can often weather economic turbulence rather well. So much so that in 2014, the HVAC industry accounted for 292,000 jobs – which is expected to grow by 14 percent by 2024.

The overall industry has a projected CAGR of 6.1% between 2021 and 2026, well above that of the overall US economy.

2. High Lifetime Value (LTV)

The Lifetime Value Calculation is how a business measures the value of a customer to its business throughout that customer’s full lifespan. Customer Lifetime Value – or LTV – is an important metric to measure a company's growth.

You can try calculating the LTV of your company using our Free Calculator.

Total Summary

- Average Purchase Value ($)

- $

- Number of Purchases (per year)

- Customer Lifespan (years)

- Customer Lifetime Value

- $

Average Purchase Value is calculated by dividing the company’s total revenue by the number of total customers over a specific time period.

Customer Lifespan is the length of time a customer will continue using your services or buying products from your company.

In the HVAC sector, residential HVAC systems must be replaced every 12 years on average, and each unit costs $12,000. In that period of time, the company will likely provide some level of service, either in the form of repairs or routine maintenance. The LTV of an HVAC business often works out to a per-year value of over $1,000 per customer.

Factors to Consider When Appraising HVAC Businesses

Now that we understand why HVAC companies make a good acquisition option, it’s time to investigate how we appraise these businesses.

Valuing a business involves calculating its worth and potential selling price.

Commercial vs Residential

Commercial HVAC businesses work in places like office buildings, schools, or churches (to name a few), while residential HVAC companies work in people’s homes or small businesses.

Traditionally, companies specializing in residential work command higher multiples (though this isn’t necessarily a valid consideration in Acquira’s opinion).

Construction vs Service

HVAC construction involves new construction jobs, where technicians will arrive at a building that is being built and install furnaces and ductwork. While service work involves maintenance, repair, and sometimes replacement work on existing HVAC infrastructure.

The Majority of construction businesses SHOULD be at least one turn lower in the multiple, though brokers don't always value them this way. We’ll explain why further along in this piece.

Starting Multiples By Business Size

The value of a business usually depends on several factors, such as size, systematization level, and goodwill, among many others.

One component of Acquira’s training is an Investment Thesis calculator, which helps you weigh different types of businesses based on various factors to see how much you should pay for a company. We base our multiples on Seller’s Discretionary Earnings (SDE).

So, for example, if the company’s SDE is $600,000, the starting multiple for a business of that size is 3.5, which means the purchase price would be $2.1 million in total. If you were to finance the payment for that business through an SBA loan, you might pay $210,000 of your own money. The calculator provides a range of valuations based on company size.

| Why SDE Is Important SDE is a standard way to value a small business. It involves recasting the business’ pre-tax income before non-cash expenses, interest, owner’s compensation, and any one-time expenses that won’t carry forward into the future. Many small businesses claim various deductions to reduce their tax burden. These deductions can lower the business income on a tax return, which causes the company’s tax return to underestimate how much revenue the business produced. The point of SDE is to give the appraiser a clearer picture of the business’ true profit potential by calculating its earnings with a new owner. In order to do this, expenses that are listed on the tax return (that aren’t necessary to run the business) are added back to the calculation, including the owner's salary and any one-time expenses. SDE is a sum of the business’ pre-tax income, plus the owner’s compensation, interest expense, depreciation and amortization, discretionary expenses (like cars, cell phones, meals, etc), plus any adjustments for extraordinary, non-operating revenue or expenses, non-recurring expenses or revenue. |

How Acquira Weighs A Business

Acquira’s Investment Thesis Calculator allows us to appraise businesses relatively quickly. We do this by weighing ten factors that we have identified as important enough to impact the value of a business.

By carefully weighing these items, we can adjust the internal purchase price across each of the starting multiples mentioned above. So, when a company scores higher on one of the items below, it raises the value of the business. “The internal price” is what we value a business at internally. A high internal price should not affect the asking price. It just means that the company is more valuable than the seller realizes. The goal is to find a company with a higher internal price than the asking price – where the truly great deals are.

The factors we look at include:

1. Company Culture

How do people feel about the work they do? Do their values align with the company’s values? Do they believe in the company’s vision for itself and how it plans to get there?

This can be a particularly hard factor to measure. To discern the health of a company’s culture, we look at the average tenure of employees by department. If the average is under three years, that can lower a company’s multiple; if it’s higher than six years, that can raise the multiple.

We also look at health benefits offered compared to the local average. Specifically, if the benefits package is well below the industry average, that can lower a company’s multiple.

There may be instances where you would limit this appraisal to the amount of turnover by segment. For example, you may want to confine your analysis to leaders or technicians while excluding CSRs or warehouse workers. We’ve seen companies with good culture in the field but bad culture in the office.

2. Brand Moat

This looks at how long it would take to build up the business review base / organic traffic base (including word of mouth) AND scores the business based on the industry itself having a moat.

For example, a business would score a higher multiple if it would take five or more years to build its review-base/organic traffic/commercial partner base. Put another way, the company’s brand moat is so strong that it would take another company five years to create something similar.

A company scores lower if it takes less than two years to build up its brand moat.

We are mainly looking at replacement costs. For context, building out a great web presence and at least 200 5-star reviews would cost about $100,000 and can be done in about a year for most businesses, where the average ticket is in the hundreds of dollars (longer for larger ticket items like roofs).

Note that you should also consider your skills, network, and assets as an acquisition entrepreneur.

3. Demographics

Are the demographics and industry growing or shrinking?

We calculate this by looking at the market share using a more specific baseline for the serviceable households: the expected frequency of service per the equipment's average life cycle or when it was last serviced. For example, the average lifespan of a furnace or air conditioner is 15 years, and replacement is the majority of the gross profit in the space.

4. Gross Profit Trend

Is the business' gross profit growing or stable? You should also measure EBITDA, but post-close it is more in your control than gross profit.

5. Seasonality

Is the business highly seasonal, and does revenue or profitability vary depending on the month? This is important to understand the working capital needs of the business. It is often managed by furloughing the workforce or introducing new, non-seasonal products or services.

6. Customer/Sales/Vendor Concentration

If a single customer takes their business elsewhere, how much will that impact their bottom line?

This is important to measure from both an economic user and the perspective of the referring user. That’s because, financially, it may seem like no single customer has more than 10 percent of your sales, but you may find that a single General Contractor is referring 25 percent of those customers to you.

Additionally, this is important to measure from a gross profit standpoint, as different work gets different margins.

7. Key Man / License Holder Risk

Are there any employees who are absolutely crucial to the business operations? If they left, could it stop the business from operating? For how long?

This could be based on an employee holding a key license, holding a key customer relationship, or being the only person in the company outside of the owner capable of doing a key job that is very difficult to replace.

8. Recession Resilience

How exposed to the overall economy is the business? This primarily impacts your down-side pro-forma financial model. We want to ensure that in the event of a recession, the owner can still make their debt payments and pay themselves a living wage. The living wage part is important, as you don't want to be forced to return to the workplace and thereby neglect your business.

We also include asset value in this part of the calculation because if it is high enough, it can override recession risk. If a business's furniture, fixtures, and equipment are a high percentage of its purchase price, your risk is lower as you can flip those assets in case of insolvency.

Banks are also aware of this and are more likely to approve you for a loan requiring less collateral (though this would be through a non-SBA loan).

You want to look at the likelihood of a recession impacting the business, as well as the impact a recession would have.

9. Management Depth

Introducing layers of management takes both time (opportunity cost) and risk (potential profit decline).

a) Mid-level Managers

Getting a manager to a point where they are trusted, capable, and confident is generally a six-month process. So, finding a business that already has this in place will allow you to accelerate your growth by six months. If the company's cultural health is poor, however, this could take up to a year (and the risk of alienating other employees is higher). You also risk promoting/hiring the wrong person and thus affecting the retention of the people they manage and their output.

b) Leadership

Building a leadership team within the company to the point where they are trusted, capable, and confident is typically a year-long process. So, finding a business that already has this in place will allow you to accelerate your growth by 12 months. If the company's cultural health is poor, however, this could take up to 18 months (and the risk of alienating other employees is higher). You also risk promoting/hiring the wrong person and thus affecting the retention of the people they manage and their output.

10. Operations Sophistication

Here, we measure how well the company uses technology and makes goals and decisions based on data. This is important as the owner will want to implement this in their business, and the implementation process takes time and carries some risk.

Typically, you shouldn't introduce large technology changes in the first six to 12 months post-close, as that can create friction. The business owner should strive to instill trust before making any sweeping changes.

If these technological tools are in place, growth could be accelerated. Note that you could implement it sooner, but the risk of alienating your team grows the faster you do it post-close.

The considerations above are part of Acquira's Investment Thesis calculator, a proprietary tool we use to help Acquisition Entrepreneurs develop their own unique collection of personal variables and criteria that allow them to quickly assess potential deals and disqualify bad ones. If you'd like to learn more about our training, schedule a call with us by filling out the form below.

What Will Increase The Value?

When deciding whether or not a business makes a good acquisition target, certain factors can increase the value of the business. When Acquira is looking at businesses, we want to see companies with strong systems, a strong culture, and a strong leadership team. Looking at these items, specifically, as they relate to HVAC businesses, allows us to find companies that are more valuable than their asking price – better known as “good deals”!

Of course, suppose a company doesn’t have these attributes. In that case, it doesn’t necessarily disqualify them from being acquired – it just means we need to ensure the missing attributes are created and fostered through our ACE Framework.

But what specific attributes make an HVAC company more valuable?

1. More Annuities in the Form of Service Contracts

Service contracts create recurring revenue for the business. The more service contracts the business has, the more its income will increase. This makes the company a less risky acquisition.

2. Strong Employees

You should look to ensure that all technicians at the company hold the appropriate licenses to work in the state where the business operates. If the technicians have a lot of experience working in the field, that’s also a plus for the business. If you have qualified and capable employees who can solve issues without the need to confer with their coworkers over a given problem, that will help build public trust in your business.

3. Potential for Economies of Scale

Economies of scale are cost advantages that arise when a company’s production becomes more efficient. If the HVAC business you’re looking at seems ripe for systematization, that could make it a more attractive target.

4. Strong (and confirmable) Financial Histories

You need to ensure that all of the financial information a business seller provides is accurate, but you also want to determine that it shows potential for growth. You should look at balance sheets, P&L (profit and loss) reports, and QoE (quality of earnings) analyses.

What Will Decrease The Value?

1. Too much Construction Exposure

Suppose too much of a company’s income is derived from new construction. In that case, that should lower the value of the business for the simple fact that it leaves the company more vulnerable to economic downturns.

When the economy is struggling, new construction slows down (indeed, new construction is a popular indicator of overall economic health). If a company relies too heavily on new construction jobs during good times, it will suffer when the work dries up during the bad times.

Plus, construction means working with general contractors, who are often tough nuts to crack. Profit margins with them are slim, and they have a reputation for not paying their bills on time.

2. Too much Customer Concentration

We discussed this somewhat above when looking at how we weigh a company, but it bears repeating: No company should rely on a single customer for most of its work. Suppose any business you’re appraising shows that one big client generates most of its revenue. That should be an immediate red flag and will definitely lower the company's value.

3. High Seasonality Without Product Lines for the Off-season

The HVAC industry is somewhat susceptible to seasonality. That is, companies do a lot of business during the dog days of summer and the coldest days of winter, but things can slow down in the more temperate months of the year. This is especially true in certain geographic regions where temperatures can range drastically in winter and summer, keeping technicians busy during those seasons but creating challenges in the Spring and Fall.

If the business doesn’t already have offerings to help combat these downturns, that should lower the value of the business. Of course, it also offers the potential to introduce new product lines and increase revenues.

Conclusion

Acquira has a history of buying HVAC companies; we believe in the business model. These companies tend to be recession-resilient and are often ripe for systematization, which can improve efficiency and, in turn, boost profits.

The HVAC services market in the United States is expected to grow by approximately $10 billion by 2030, making these businesses an attractive investment regardless of how much you can grow them post-acquisition. However, there is immense growth potential if you work to systematize these companies and install a competent leadership team.

We know how important HVAC companies are for people – emergencies can pop up at the most inopportune times! Do you have any good HVAC-related stories? We’d love to read about them in the comments below.

Acquira’s Accelerator+ Program is designed to take an Acquisition Entrepreneur through finding, vetting, and acquiring a business all the way through post-acquisition growth and onto an eventual exit from the business (for more than you paid). If you’d like to start your acquisition journey, schedule a call with one of our representatives by filling out the form below, and someone will be in touch shortly.

Key Takeaways

- SDE is an excellent way to determine the starting multiple of an HVAC business.

- An overreliance on construction should lower the multiple of an HVAC business.

- Service contracts can create reliable recurring revenue for an HVAC business.

- Traditionally, HVAC companies that specialize in residential work command higher multiples.

- HVAC businesses are prone to seasonality – look for businesses with other product lines to counteract this issue.

Acquira specializes in seamless business succession and acquisition. We guide entrepreneurs in acquiring businesses and investing in their growth and success. Our focus is on creating a lasting, positive impact for owners, employees, and the community through each transition.