- A simple step-by-step process for creating a business budget

- The intimate details of your budget to understand how it works

- Free small business budget apps and templates to get started

- An example of a small business budget that you can copy

- Quick answers to your questions about your business budget

Can you think of going on an exotic voyage without having a travel itinerary or budget? Most likely, not.

The same applies to your small business. Large corporations and small businesses use budgets to plan how to use the lifeblood of any company — money. To keep it going, you need strategic planning in managing its finances.

As a small business owner, you might find it intimidating to make a budget when you’re already sailing the ship with tons of responsibilities. But that doesn’t change the fact that budgeting is an important process that you can’t afford to skip in running a successful business.

One of the biggest reasons why most small businesses fail in their early years is not having a proper business plan and not enough financing. A well-planned small business budget is one way to save your business from crashing.

In this step-by-step guide to creating your small business budget, we'll walk through how to create a budget in order to give your business a better chance to survive and grow.

What is a Small Business Budget?

A business budget is a plan of action for how your business revenue will be spent. It is a forward-looking financial plan that every business must have.

The concept of budgeting is all about identifying your available resources, estimating your expenses, and planning ahead. It is one of the first and most important building blocks of your business action plan.

The concept of budgeting is all about identifying your available resources, estimating your expenses, and planning ahead.

A small business budget is an alternative to capital budgeting adopted by large corporations. You can think of a business budget as a snapshot of your future expenses and revenues that will help you make important strategic decisions about your business.

A well-crafted budget helps a business take many decisions like increasing or decreasing marketing and HR costs, leveraging new opportunities, purchasing equipment, etc.

Why is a Budget Essential for the Success of Your Small Business?

Before we get into how to create a small business budget, it is important to answer why a business needs a budget.

1. Helps manage business cash flows

Building a small business budget does not only help to make informed decisions about the business, it also helps in managing the cash flows.

The importance of budgeting cannot be undermined as 82% of small businesses fail because of poor cash flow. Cash flow problems are the #1 reason for small business failure. And what’s the solution?

A viable budget for a small business is one of the solutions. When you’re running your business, there are a lot of unexpected events, financing needs, and growth prospects. If you do not have a plan for taking action, there is a chance it will lead to irreversible cash flow problems.

2. Credit problems

Not having a budget can also raise credit problems for your small business. When you do not know your estimated expenses, you have no idea when and where to invest your money. For instance, you’ve taken a business loan out to fund your business. How can you tell where to invest it when you don’t have a carefully crafted budget for each dime of that loan?

As a result, you misspend and under-utilize the credit in unimportant activities — like paying the bills which has no return compared to money spent on marketing campaigns. If you have a budget, you can improve your credit utilization ratio as well as have impressive ROI on your credit investments.

3. Every penny gets a job

Misallocation of resources is a plague that is equally harmful to small businesses and large corporations. Resource allocation helps a business to get a clear picture of work that has been done and work that needs to be done. Knowing how to build a small business budget and sticking to it also helps proper resource allocation.

If HR needed $5000 last year for staffing and recruiting, it does not mean that the same amount should be allocated next year. In zero-based budgeting, the budget resources are allocated on a need basis. It is possible that this year marketing and advertising needs higher amounts. And you can know this only if you have a budget prepared ahead of allocation.

4. You don’t have to wait for leveraging investment opportunities

As one of the biggest reasons why businesses fail in the initial years is not having enough financing, it means that they do not have funds to invest when the right opportunities present themselves.

As a result, they cannot leverage the business growth opportunities necessary for a business breakthrough.

However, when a small business has planned everything and kept a budget to invest in new opportunities, it can grow without burdening the business with loans.

5. Informed decision making

The role of the budget as a managerial decision-making tool is unquestionable. When a business has a prepared budget for the future, it has a foundation to compare its performance.

When a business has a prepared budget for the future, it has a foundation to compare its performance.

At the end of every year, the financials from profit & loss statements are compared with estimations defined in last year's budget. It helps the business owner to identify the differences in planned and actual figures to help in future decision-making.

Take an example of a small business that prepared a business budget and found the income can support the investment of $20,000 in marketing. The marketing person thinks that a new media campaign worth $30,000 is a fantastic growth accelerator.

But you will already know how much your small business can spend on marketing. That way you won’t overspend and instead use $20,000 for other marketing efforts.

Now, let’s get into a simple process for creating your own budget.

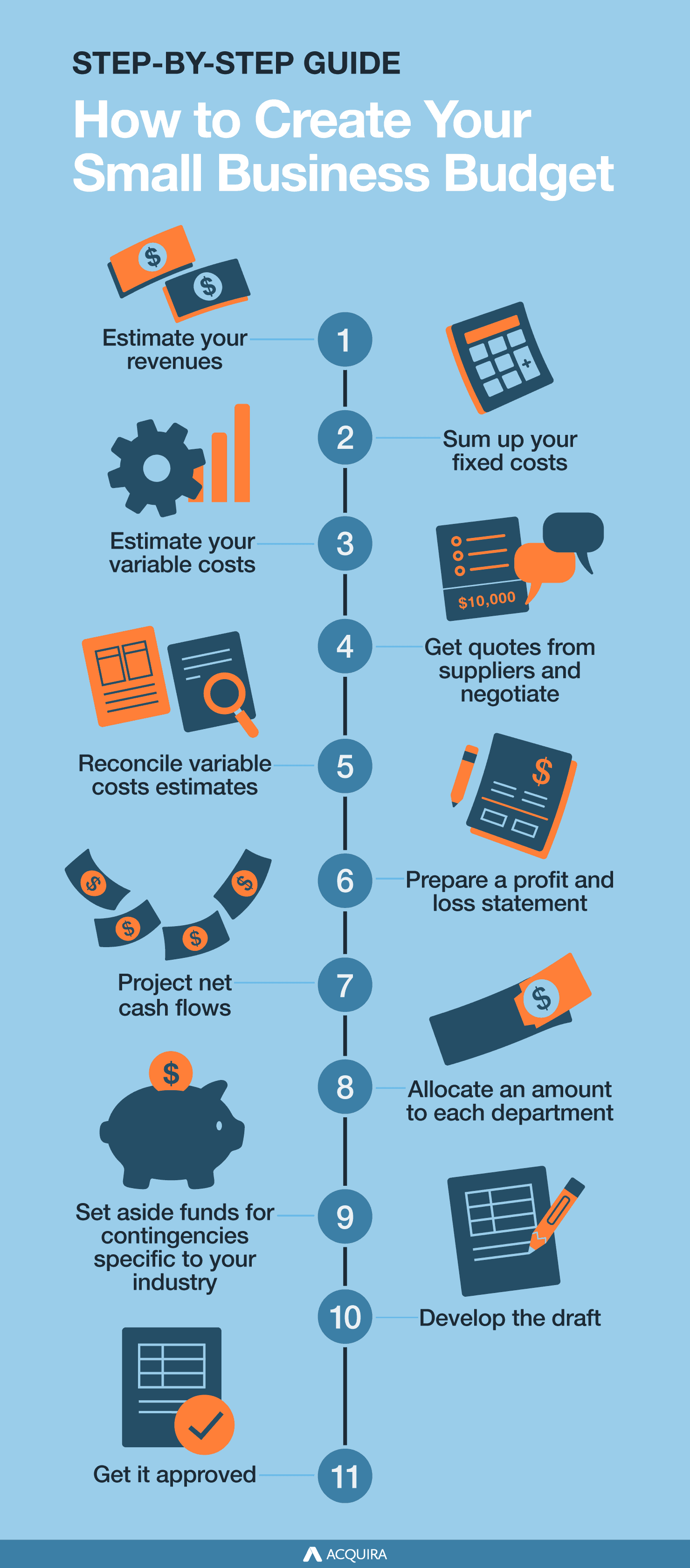

Step-by-Step Guide to Create Your Small Business Budget

Before we get into the steps of making a budget, it is important to know that a realistic budget is a goal, not just a sum of unrealistic calculations. Your business budget must be

- simple to understand

- based on logical facts, and

- useful for business operations.

1. Estimate your revenues

The first thing you’ll do in your budgeting process is gathering all your business’s income sources. Consolidate them to have an estimate of total revenues for the next financial period.

Either do it as monthly estimates and a final consolidation at the year-end. Or you can go with an annual estimation depending on your business model.

Some examples of your income sources can be:

- Income from business operations

- From investment in securities

- Income from consultation services

It is not necessary to have multiple streams of income. It solely depends on the type of business you’re in.

2. Sum up your fixed costs

Once you’ve logged all income from different sources, estimate your fixed costs. Fixed costs are the business costs that remain the same regardless of how much sales you’ve made.

For instance, if you’ve rented a building for your business, the rent expense will remain fixed irrespective of if you’re making sales or not.

Fixed costs are important to manage because this is an opportunity for you to minimize your fixed costs by proper planning. Other fixed costs could include payrolls, utility bills, etc. Sum all your fixed costs because they’ll be present irrespective of your sales and variable costs.

3. Estimate your variable costs

Moving forward, you’ll estimate the second part of your business costs: variable expenses. Variable expenses, as the name suggests, vary with the level of sales or revenues.

For instance, in a manufacturing business, raw material is a variable cost. They will only purchase raw materials when manufacturing is done. The use of material also varies according to the number of units produced and sold.

The variable costs of your business might vary from month to month or every year. Usage-based utilities, shipping costs of orders, etc., are common variable expenses most businesses incur.

A great thing about many variable costs is that they can be negotiated with suppliers. So why not leverage this opportunity? That’s what you’ll do in the next step.

4. Get quotes from suppliers and negotiate

After having your own estimation of variable costs, start getting quotes from the suppliers. Check different suppliers for the services you need. Compare the quotes of different suppliers and then try to negotiate with ones you consider fit for your business.

Chances are higher that you’ll have successful negotiations and, as a result, lower variable costs per unit.

5. Reconcile variable costs estimates

Now when you’ve got quotes from the suppliers, reconcile the estimates. It will make the picture clear about what to expect from your budget in the future.

6. Prepare a profit and loss statement

If you’re not new to the business, you will have a profit and loss statement from the last financial year. Taking the profit & loss from last year as a base, prepare one for the future based on your estimates.

You’ll get profit estimates by doing this. Why is it important to get an estimation of profit?

These estimates will help you plan how much money you have to reinvest into the business.

7. Project net cash flows

Cash flows are of two types: inflows and outflows. The net cash flow of a business is a difference between inflows and outflows. So far, you’ve prepared the estimations of revenues, expenses, and estimated profit for your business. You can also project how much cash you will retain during the next financial year.

The positive cash flow signifies excess cash and negative cash flows show cash shortage. Estimating your cash flows is important in creating a small business budget because cash is the lifeblood of every business.

8. Allocate an amount to each department

After estimations, it’s time to allocate a budget to each department based on the estimated values.

For instance, you had estimated marketing expenses will be $15,000, and your revenue estimates are $500,000. If we follow the percentage method, the marketing budget will be allocated as 7.5% of the revenue.

Follow a similar process for each department and expense for allocation of budget. The small business budget percentages need to be accurate as they will dictate future operations.

9. Set aside funds for contingencies specific to your industry

You cannot afford to let problems meet you unprepared in business, no matter how quick you are at thinking on your feet.

Plan for what is difficult while it is easy, do what is great while it is small.

Sun Tzu, The Art of War

Therefore, analyze your industry and any seasonal requirements to maintain a contingency fund for unexpected events.

Besides the unexpected expenses, you need contingency planning for any probable expenses that might occur in the future. For instance, you might have a lawsuit pending a decision. So you’ll maintain a fund on the off chance that you lose the lawsuit.

10. Develop the draft

Bravo! You’ve done most of the work.

Now it’s time to consolidate all the estimations into a budget draft. The estimated P & L and cash flow statements will give you a pretty good idea of the amount you’ll have to play with.

11. Get it approved

Share the budget draft with your team and ask for feedback. After feedback, address any reservations from a team member or reconcile the draft for any changes suggested by team members. Get the final budget approved and implement it in the future.

At the end of the financial year, compare the actual values with estimates and take corrective actions for the future.

Get the Picture: Sample Small Business Budget

Let’s check out an example of a small business budget. We will follow all the steps in making the budget as discussed above to have a consolidated budget at the end.You can also start with these free small business budget templates for Excel or Google Sheets. To use with Google Sheets, download the template, send it to your Google Drive and open it with Google Sheets.

Revenues Estimation (Monthly)

| Description | Estimates |

| Income from operations | $10,000 |

| Income from investments | $1500 |

| Consultation fee | $4000 |

| Total Income | $15,500 |

Expenses (Fixed)

| Description | Estimates |

| Utility Bills | $400 |

| Software Charges | $100 |

| Payroll costs | $2500 |

| Internet | $100 |

| Office Rent | $1000 |

| Cell Phone Bill | $70 |

| Interest On Loan | $100 |

| Government Fees | $40 |

| Total Income | $4310 |

Expenses (Variable Costs)

| Description | Estimates |

| Sales Commission | $1500 |

| Electricity Bill | $100 |

| Printing Services | $150 |

| Water Bill | $100 |

| Office Supplies | $200 |

| Digital Advertising Costs | $1000 |

| Transportation Costs | $100 |

| Shipping Fees | $100 |

| Total Income | $3250 |

P & L (Monthly Profit & Loss Statement)

| Description | Estimates |

| Total Income | $15,500 |

| (-) Fixed Expenses | (4310) |

| $11,190 | |

| (-) Variable Expenses | (3250) |

| Net Profit | $7940 |

Cashflow

It is based on the estimation that there will be no credit purchase or credit sales. Therefore, the cash flow will equal the net profit. However, it can be different depending on the business policy of credit sales and purchases, as well as collections.

Estimated Inflows = $15,500

Estimated Outflows = $4310 + $3250 = $7560

Net Cash flow from operating activities = Inflows – Outflows

Net Cash flow from operating activities = $15,500 – $7560

Net Cash flow from operating activities = $7940

This example can be treated as a small business budget sample when you’re preparing your business budget.

Free Budget Templates to Use for Your Business

We’ve collected some best budget templates that you can use as a small business budget example or a template itself. The templates can serve as a small business budget tool that is convenient and reusable in the future.

Small business budget template for Excel

If you’re an Excel user, you have a lot of choices for budget templates. However, choosing one that caters to your business needs and is simple to understand is quite a job.

Here is a small business budget template for excel that you can play around with. The template has everything sorted with automatic calculations of variances for expenses and income. You can also perform different analyzes on your financial data.

If you’re someone who isn’t comfortable working with macros, this budget template breaks down all expenses, revenues, variances, etc. You will not have to worry about macros within the budget on a monthly and annual basis.

Small business budget template for Google Sheets

Not an Excel person? Try this template on Google Sheets. If you need more downloadable options, check here.

PDFConverter.com budget templates

There is an assortment of 15 small business budget planners by PDFConverter.com that you can use as well. You can choose a template according to your business type, needs, etc. Either you’re looking for a marketing budget or budget planner to apply for a loan, you can get a template for it.

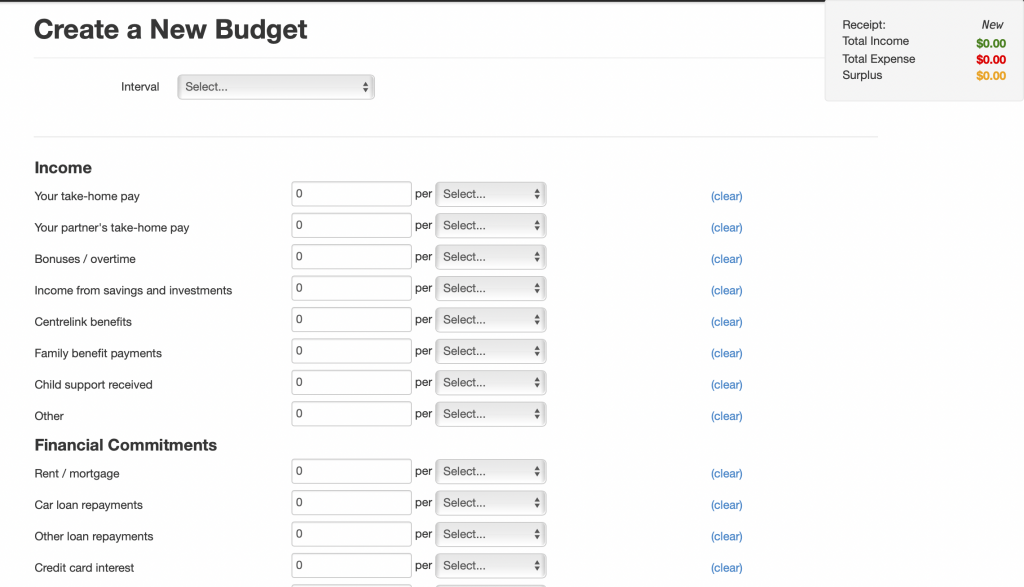

Free and Open Source Small Business Budget Software

More businesses are shifting to accounting software for making budgets, tracking expenses, recording revenues, and doing financial analysis. The percentage of businesses relying on budget software has grown to 43% in the US alone. You can also switch to automated budgeting by choosing from different small business budget software for free. Many small business budget apps let you create and track your budget on a monthly and annual basis.

Here are some free and open source small business budgets you can try.

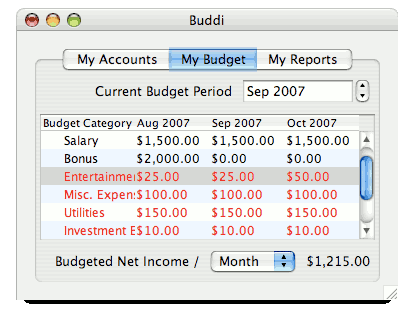

Buddi

Buddi is a personal free finance software as well as open-source. You can play around with the software and switch to any language from the multiple language choices available. The software can run smoothly on most operating systems, including Windows, Linus, Macintosh OS, etc.

You have the freedom to export, import, or synchronize data with the software for smooth working and reporting. Buddi can be used for personal budgeting, small business budgeting, and the budgeting of large corporations.

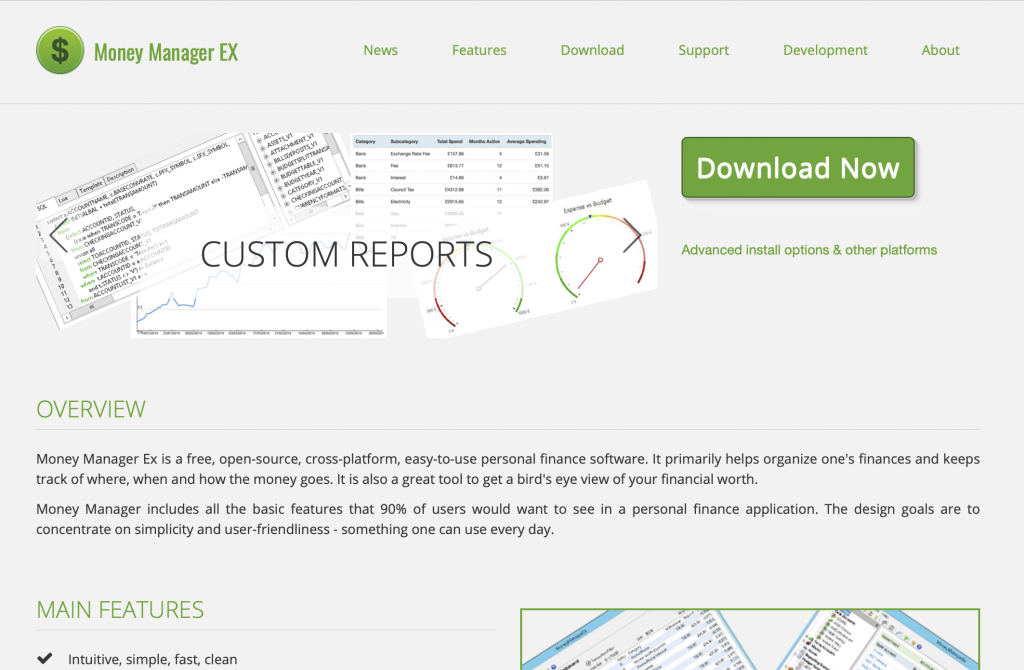

MoneyManagerEX

MoneyManagerEX is also free and open-source software. You can easily collaborate and share your financial data with team members to give feedback, make changes, or suggest reconciliations. It is perfect for managing your small business budget, including bookkeeping, collections and reimbursements, and capital management.

In short, it is an all-in-one software that will cover all finance-related requirements of your business in addition to budgeting. You can work on the web-based or desktop version.

The desktop version is more stable though. You can also choose your native language for the interface and translate the reports in any language from 8 available choices.

Divvy

Divvy is yet another software developed for savvy entrepreneurs who want to do budgeting with freedom. Divvy is not too old in the market, but the features it offers are impressive. You can use the software with Mac OS, Windows 10, Web Browser, G Suite, etc.

Besides the web-based version, Divvy has an impressive small business budget app offering convenient drafting and tracking of the budget on the go.

Budgeter

If you’re looking for a simple, easy-to-use yet impressive budget planner, budgeter is perfect for you. You don’t have to download or install it as it is web-based and super lightweight. Without an extraordinary knowledge of Excel and spreadsheets, you can comfortably work with this budgeting tool.

There are other small business budget software that you can try for free. However, you can also try the paid versions for more automation and convenience. Such as:

FAQ

You can create a small business budget in 5 minutes if you have all the estimates ready. All you have to do is to download a budget template, input the values, and get the automated output for the estimations.

Similarly, you can also calculate the variances by automated calculators integrated into the templates or budgeting software.

There is no absolute value of how much a small business budget should be. It can differ based on the type of business you’re in, the business stage, your target market, sales, etc. A freelance writing firm’s budget will be different from a big city restaurant’s budget.

You can create your own in-house reusable business budget template by following the step-by-step guide we’ve shared above. Besides, you can also use a business budget template as a reference and modify it according to your unique business needs.

More broadly, budget records estimated revenues, fixed expenses, variable expenses, and profit margin. Every section is sub-categorized according to the types of expenses and revenues. You can check the step-by-step guide to create a small business budget to know what should be included in a small business budget.

The answer is ‘it depends.’ Your marketing budget is always a specific percentage of your revenues. Suppose you’re running a small business targeting B2B (Business to Business) customers, your marketing budget can be between 2 to 5% of the revenue.

A B2C (Business to Consumer) business can have a higher budget between 5 to 10%. However, it is not a fixed budget but a common practice in the industry. Your marketing budget can vary depending on unique needs and return on investment.

Key Takeaways

Small business budgeting is crucial to the success of your business. Without a business budget, you cannot track where, when, and what to spend. Cash flow shortage and low financing are some of the biggest reasons businesses fail. Therefore, you cannot afford to ignore your business budget to grow and sustain in the industry.

There are many free templates, open-source software, and applications for budgeting. You can leverage them to plan, implement, and track your business expenses to help you make informed decisions.

Creating and analyzing the financials of a potential business is something our team guides you through in our Acceleration Program. If you are interested in learning more about this process, you can schedule a call with us.

Acquira specializes in seamless business succession and acquisition. We guide entrepreneurs in acquiring businesses and investing in their growth and success. Our focus is on creating a lasting, positive impact for owners, employees, and the community through each transition.