- Five basic but smart reasons you should sell your business

- How to sell your business to the right buyer and get the most out of your decision

- What you need to do to make the sale a smooth process

- The details that need careful attention to avoid costly mistakes, and

- Answers to the most common questions owners ask regarding selling their business

You’ve spent years of hard work, dedication, and sacrifice to grow your business to its current standing. Although the thought has crossed your mind several times, you’re not entirely sure selling your business is a smart move.

Why Should I Sell My Business?

As an entrepreneur, you’re familiar with making wise financial moves after careful consideration. Selling your business is definitely a difficult decision that requires careful consideration.

Of course, at Acquira, we work with a lot of talented Acquisition Entrepreneurs who are interested in buying businesses and continuing to grow them. If you're interested in connecting with us, we recommend you start here.

Here are some reasons to consider an exit strategy and reap the fruits of your labor while you can:

1. Risk

Running a business is a risky endeavor. The forces that influence a business’s success can be too much to handle at times.

You may find you’ve spent the last 5-10 years hanging on by a thread. You don’t know how much longer the thread will hold things together.

This may be an excellent time to move on from the business. Because the longer you hold on, the riskier it gets. You don’t want the volatile nature of running a business to catch you at a bad time.

Consider transferring this risk to someone else while you take the cash and move on to something less risky.

2. Retirement

Sometimes it’s as straightforward as this: You’ve spent 3 to 4 decades of your life building, growing, and nurturing your business. Now, it’s time to rest. You can sell your business when the desire or necessity to retire comes.

Selling your business can finance your retirement plans — whether you intend to pay off your mortgage, move to a new location, buy a new house, or start another kind of business.

Ensure that your profit from the sale of your business is sufficient to fund these plans before moving forward with them.

3. Changes

The world is constantly changing. You can change as well. You’ve probably lost interest in your current business. And that’s okay, boredom usually sets in when we do the same things for a long time.

You can sell your business and use the money to pursue a new interest. As opposed to running two businesses at once, dedicate your full attention to your new venture and ensure its success.

Also, changes in your personal life can influence your decision. Maybe your health took a different turn. For a job that requires constant activity and movement, certain health conditions can affect your productivity and performance.

In those cases, your business may fare better in different hands.

4. Time

Times change, and then make it necessary to put your business up for sale. For instance, technological advancements create solutions that become widely used and make it hard to compete.

Or industry regulations that cause major changes that are hard to keep up with.

In both cases, you may not have the money or resources to adjust to such changes. Then you need someone with the capital to take over and keep the business alive.

A business is most valuable when it’s bringing in increasing profits year after year.

In another scenario, your business is doing well, and profits are growing. This could be a viable sign to put your business on the market. A business is most valuable when it’s bringing in increasing profits year after year.

Some sellers believe that is the peak of their business performance and an excellent point to make an exit.

Also, if the economy is great and the buyers' market is booming, you can get offered prices that are too hard to refuse. Business buyers could even go on bidding wars, and that means more money for you.

5. Money

Also, it may be as simple as converting the value of your business to liquid cash you can use for various purposes.

Maybe you need cash to travel the world, chase a new hobby, start a new business, pay medical bills, or attend to another emergency. Whatever the case may be, selling your business can provide you with the liquid capital to do what you want.

On some occasions, a buyer may pick a particular interest in your business. So they offer you an amount many times above its market value. It’s a rare opportunity most people won’t miss.

Before you Sell Your Business…

Decide on Your Ideal Buyer

If your business is dear to you, you’ll be concerned about the quality of buyers whose offers you entertain.

Think about the exact characteristics of the buyer you want to give ownership of your business before going to market. Use that to pre-qualify the offers you receive.

Watch your Timing

There’s an excellent time to sell (during an economic boom or when profits are on an upward trajectory), and there’s a bad time to sell. Pay attention to your timing and be sure it’s the right time before going to market. Right timing means more profits from the sale.

Prepare the Business

When you decide to sell, prepare early (a year or two ahead). Put financial records, business structure, and customer base in order to make your business more attractive to buyers.

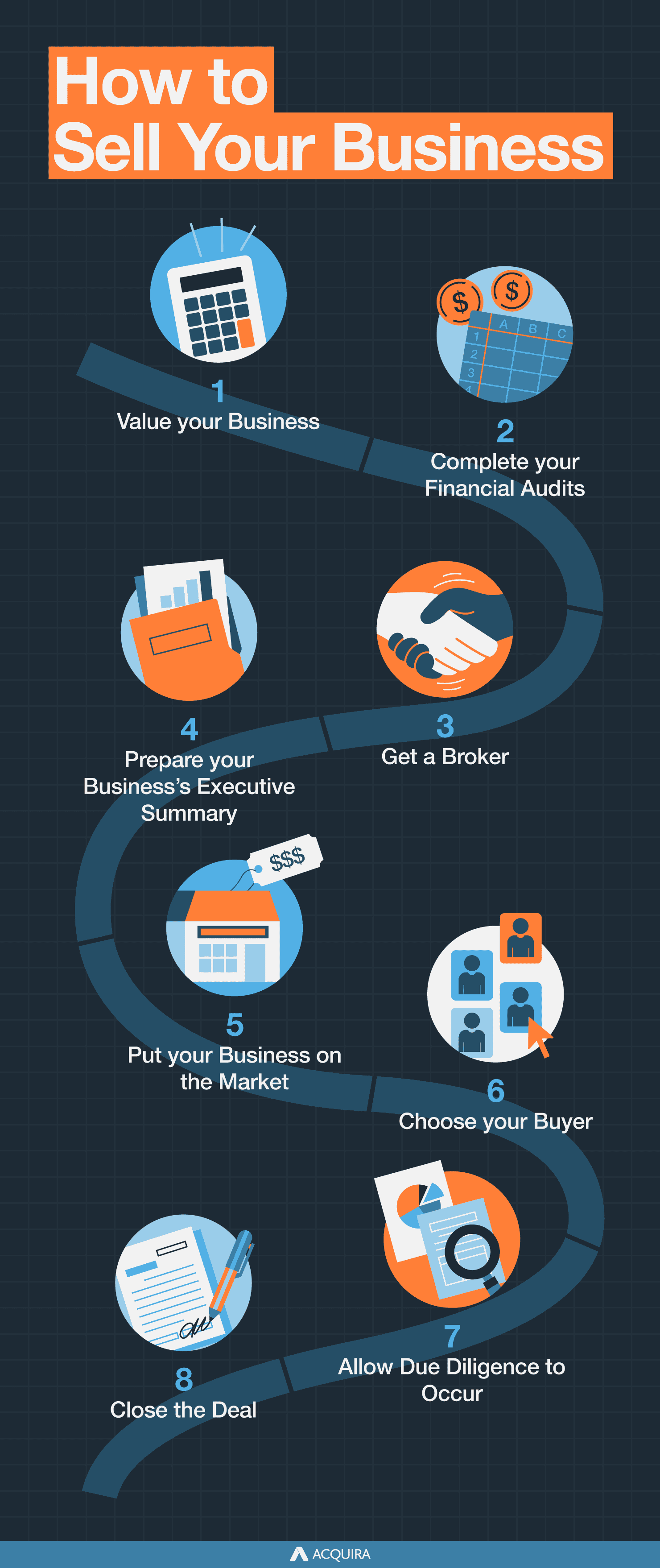

How to Sell Your Business

Some people choose to sell their businesses themselves. They don’t mind handling the hassle and delicate details of the transactions.

However, for you, it may be better to pass through a brokerage firm to land reputable buyers at great prices. But you’ll have to make your business attractive to such buyers.

Let’s show you how before we dive into the actual steps to sell your business.

How to make your business more attractive to buyers:

- Grow the profits of your business

- Keep your revenue consistent and increasing, and

- Build a strong base of recurring business/business customers

1. Value your Business

Most people calculate the value of a business as multiples of its yearly profit (EBITDA Multiple). This ranges from 2 to 10 times the annual income. It is a popular valuation model on Main Street.

So essentially, the larger your net income, the more valuable your business is to buyers.

You can get an appraiser or valuation firm to determine the value of your business in a much more professional and accurate manner.

Trying to do it yourself might yield inaccurate numbers that lead to disappointments. Also, an appraiser’s valuation can add authenticity to the price you offer buyers.

If you'd like to get an idea of how much your business is worth, we've created a handy tool. Simply fill out the form below:

2. Complete your Financial Audits

Since buyers are more attracted to businesses with a stable profit and long-term profitability potential, it’s best to put your finances in order.

Work with your accountant to prepare accurate financial documents for the past 3 or 4 years. Accurate copies of these documents (balance sheet, cash flow statement, etc.), along with complete tax returns, settle your buyer’s minds.

When you are prepared in this area, it can make the selling process significantly more smooth.

3. Get a Broker

You can handle the sale yourself, or you can get a broker. Sometimes, selling your business by yourself isn’t a big deal, like when you’re selling a small business to a close friend or family member. In other cases, a broker is indispensable.

With a business broker, you can

- Get a higher valuation because of their experience and insights

- Land a better offer through expert negotiation

- Get faster and error-free sell-side due diligence

- Reach more buyers quickly by tapping into the broker’s network

- Keep the deal confidential, and

- Vet buyers more systematically

If you’re looking for the previous things mentioned, consider working with Acquira to find the right buyer for your business.

4. Prepare your Business’s Executive Summary

With a broker by your side (or by yourself), prepare a concise executive summary of your business. This will include major points that give a clear picture of your business to prospective buyers.

Points such as

- Business operations

- Objectives or mission

- Products and services

- Current financial standing and history

- Employees

- Marketing and sales strategies

- Competitive analysis

5. Put your Business on the Market

When everything from 1 to 4 is set and ready, it’s time to get your business on the market. If you’re working with a broker, they can help you locate the ideal buyers for your type of business.

There are several marketplaces to list your business & business items for sale and increase your exposure to buyers. You can advertise your business for sale for free on GlobalBX and meet buyers on BizBuySell or BusinessesForSale.com.

6. Choose your Buyer

Pre-qualify your buyers before entering into an agreement. Ask important questions to assess a potential buyer:

- Find out if they have secured funding for this transaction. Also, ask for proof that they have the capital to make the down payments and finance business operations for the first 6 months.

- Are they ready to make a purchase immediately? Some buyers may not fit into your timeframe and that’s fine. Just ensure you get someone who’s ready to buy when you’re ready to sell.

- Ask if they have the experience and ability to run a business. Even without experience, see if they have enough knowledge about the field to handle business operations.

Use this to create a shortlist of qualified buyers so you don’t waste your time with the wrong ones and risk exposing your intent to sell.

7. Allow Due Diligence to Occur

This stage is difficult if you’re handling it by yourself. Lots of delicate legal documents (purchase agreements, asset listings, bill of sale, non-compete agreements, etc.) are required. Some are up to 50 pages long.

But with a business lawyer, you will get a thorough process that protects you and your interests.

50% of business sales fail during due diligence. Follow the proper processes with the right lawyers to prevent your transaction from becoming part of that distressing statistic.

Allow 60-120 days for your buyer to go through their side of the due diligence process.

8. Close the Deal

When all is said and done correctly from steps 1 to 7, you can close the transaction, open a bottle of champagne, and celebrate a successful business sale. The next step is to plan a smooth transition process.

If you want information on transitions, check out this post.

Or, Sell It To Acquira!

Acquira works with hundreds of Acquisition Entrepreneurs eager to buy businesses and grow them. We train our AEs to respect company culture and owner legacy, empower employees, and implement systems so that everyone continues to succeed.

In fact, if you meet our criteria, Acquira will buy the business from you at fair market value, without providing a cash-out opportunity for a middle-man.

You can find out if your business qualifies with a free valuation.

FAQ

The market value of your business is usually based on multiples of your yearly earnings/profits. Although on a more detailed level, there are several factors that determine how much a buyer will pay for your business. This includes cash flow, historical financial performance, recurring revenue, location, industry, and the current state of the economy.

On average, it takes about 6 to 8 months. Larger deals usually take a longer time to close. But ideally, you can complete the sale of most businesses in 7 months.

Going through the right channels to sell your business should be confidential. If you choose to sell your business through Acquira, we will keep your business name and other sensitive information hidden until the buyer agrees to a confidentiality agreement.

If your price and terms are right, you can attract buyers faster. Speed up the process even further by removing up-front payments and offering an earn-out.

An earn-out shifts some of the cost of the business to the future, where the buyer pays you a certain amount if the business reaches a performance goal you both agree on.

Selling your business by yourself can be a hassle, especially if it’s your first time. You have to hire a CPA and attorney for taxes and legal issues respectively. And that’s besides navigating the complex intricacies of such a major transaction.

To avoid making expensive mistakes while simplifying the process, work with an experienced firm like Acquira. We’ve successfully helped close many transactions just like yours — with everyone involved happy with the outcome.

The best time to sell your business is when it is most valuable and attractive to buyers. This is usually when the business is doing well and bringing in a continuous stream of increasing profits.

The best brokers look out for you as well as the future of your business. They help you land the right deal for your business that's fair to all parties involved. If you’re looking to sell a company with $0.5 – 10 million in yearly revenue, try Acquira.

Key Takeaways

Whether you’re retiring, need some cash, or deciding to change career interests, selling your business can prove to be a smart move.

After you’ve decided on your ideal buyer, prepared your business, and chosen the right time, start working on making it more attractive for sale by:

- Growing the profits of your business

- Keeping your revenue consistent and increasing, and

- Building a strong base of recurring business/regular customers

Next, follow this step-by-step process to close a successful sale:

- Value your business

- Complete your financial audits

- Get a broker

- Prepare your business’s executive summary

- Put your business on the market

- Choose your buyer

- Allow due diligence to occur

- Close the deal

Do you want to sell your business? Let Acquira help you remove the frustration from the process and complete a smooth sale that protects your team, and company culture, and keeps your businesses operating for years to come. It all starts with a free valuation below.

If your business qualifies for our program, Acquira will buy it for fair market value. Then you can retire. Sleep easy knowing your people are taken care of and your legacy will live on. Find out how much your business is worth to begin the conversation.

Acquira specializes in seamless business succession and acquisition. We guide entrepreneurs in acquiring businesses and investing in their growth and success. Our focus is on creating a lasting, positive impact for owners, employees, and the community through each transition.