- Why small businesses are a great way to invest during a recession.

- How to identify recession proof businesses.

- How the SBA is making it easier to receive loans to buy a business.

- How post-acquisition growth can provide additional opportunities to profit during a recession.

The word “recession” seems omnipresent lately, and with good reason.

As Bloomberg reported, it seems almost certain that the United States is heading for a recession within the next 12 months. While that word can spark fear and uncertainty among investors, there are methods for navigating these turbulent times while protecting your money and assets.

Indeed, while inflation may be soaring and the stock market may be tumbling, there are recession proof businesses that can help you profit during these uncertain times.

A recession is temporary, and it means negative growth of the GDP for two consecutive quarters. Buying an existing small or medium-sized business (SMB) – especially a recession-resilient business – can be a very effective way to get through a recession. After all, when you buy an existing company you get its customer base, staff, and you receive immediate cash flow.

If Acquisition Entrepreneurs make the right moves during a recession and take advantage of SBA programs, they can pay low prices for a small business that will significantly increase in value when the economy recovers.

Despite the recession, around 80 million Baby Boomer small business owners are approaching retirement age. This represents trillions of dollars worth of assets that need to switch hands and millions of jobs that could be at risk.

The Small Business Administration (SBA) has been working to solve this problem, using federal funds to help transition these businesses to new owners. As a result, the terms on these loans are very favorable, including relatively low interest rates, favorable repayment terms, and a low down payment.

The SBA itself doesn’t fund loans but serves as a guarantor, guaranteeing payment to the lender for a portion of the loan in case the loan defaults. For lenders, this mitigates the risk of lending money and makes them offer much lower interest rates.

Combining all of the above factors makes it clear that Acquisition Entrepreneurship is one of the best investment opportunities in the United States right now, especially given the looming recession.

If you'd like to learn more about how Acquira can help you acquire a small business, simply fill out the form below to schedule a call with an Acquira representative.

Buying A Small Business: The SBA’s Favorable Terms

In this article, we’ll discuss what makes these businesses a less-risky investment. First, we want to dig a little deeper into the numbers.

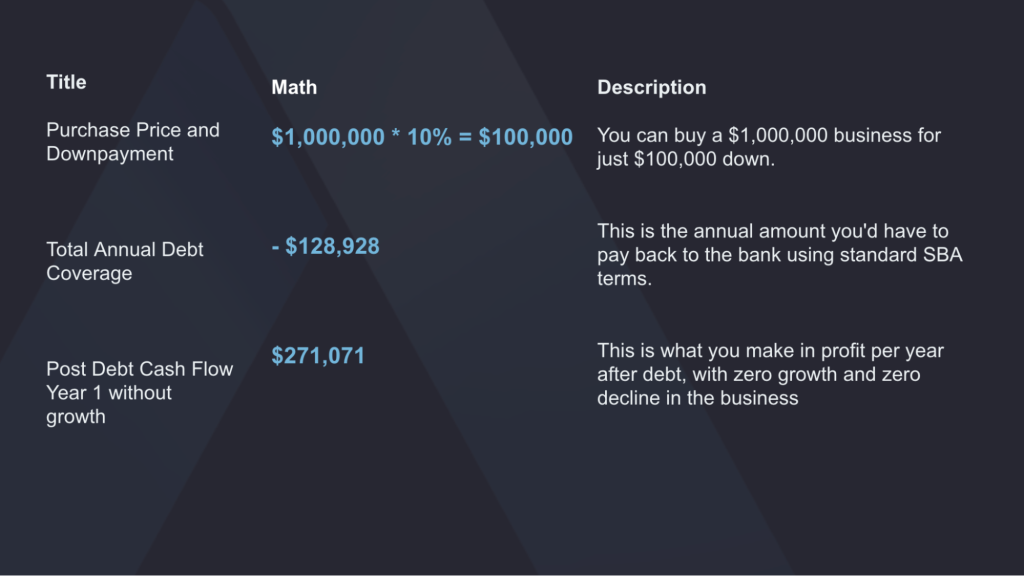

Entrepreneurs can borrow up to 5 million dollars through the SBA, with up to 90 percent leverage. So if a business costs $1 million dollars, you only need $100,000 in equity.

In that example, the remaining $900,000 would be paid off over 10 years, often at interest rates of around 7%. This would result in an annual debt payment of just under $130,000.

Moreover, these businesses are still traded cheaply. The purchase price for a business earning less than a million dollars of EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) per year is typically 2-3 years worth of EBITDA.

That means, our business valued at $1 million is likely making $400,000 per year. Subtract your debt payment from that 400K, and the business is now generating over $270,000 per year in EBITDA, even without growing the business.

That’s a 270% return on your equity in just the first year. Even if you invest an additional $130,000 in the business for more staff and systems so it can grow, it’s still $140,000 per year.

Changes Coming For SBA Loans

The SBA has begun to double down on these initiatives in recent months. In September, it announced that it would slash lender service fees and “up front” loan fees through fiscal year 2023. While those fee decreases were largely concentrated on loans below $500,000, the move still indicates that the SBA is taking steps to ensure more people have access to loans.

A short time later, the SBA announced that it would be lifting a 40-year moratorium on new Small Business Lending Companies, opening up the door for Fintechs and other alternative lenders to apply for a licence to offer SBA-backed 7(a) loans.

In short, the SBA is moving to open more loans to more business buyers.

What Type of Business Should You Buy During Recession?

At the risk of sounding obvious, recession proof businesses are the best businesses to buy during a recession.

But what exactly is a recession-resilient business?

During times of economic difficulty, most people can’t afford to buy new homes, so they turn to the homes they have and look for ways to make improvements. This may mean repairs to the roof, air conditioning, or fixing plumbing. Essentially, anything to make their homes valuable and more comfortable.

| Note: This can actually work against some home services businesses if they serve the construction industry. Many companies provide a combination of service and construction. The trick is to look for companies without too much customer concentration. |

Businesses that can tap into this need tend to do very well during recessions. This is true whether you’re talking about home service franchises or family-owned companies that have served a community for generations.

The categories of recession proof businesses have a few specific things in common:

- They produce goods and services that are needed whether the economy is strong or weak (businesses that support consumption staples such as food, healthcare, and shelter).

- They don’t rely on consumer optimism as a key determinant of making a sale (i.e. luxury yachts and handbags).

- They are nimble in their ability to shift business models or product offerings to those more in demand during an economic slowdown (don’t require major re-training or acquisition of new assets).

- They have the ability to scale their workforce up or down as needed to meet demand.

Another way to determine whether a business is truly recession-resilient is to ask yourself some key questions:

- Who comes to my house?

- Would I pay over $80/hour for their service?

- If I lost my job, would I still pay for this service?

One business sector that meets all of the above criteria is home services.

Businesses with many assets – and most home services companies are asset-heavy companies with trucks, tools, and machines – are also more recession-resilient. This is true because, if a recession happens, you can sell those assets for close to the purchase price.

Making It Count: Post-Acquisition Growth

One of the things that make home services companies such great acquisition options is that there is incredible potential for growth. These companies have been family-run for generations and have established themselves in their communities, providing a strong foundation for growth through digital marketing.

An investment in digital marketing can grow a company’s total addressable market by an impressive amount, providing immense potential.

A website redesign and increased social media presence can attract many new customers. When this strategy is effectively deployed, the hard part is often just keeping up with demand. A systematic approach to this strategy can yield great results.

Conclusion

Recessions can be scary, but they can also offer great opportunities if you know where to look. For instance, recessions often present an opportunity to have favorable terms and valuations with sellers. This often means increased seller financing on deals because there is less competition from other buyers.

The current state of Acquisition Entrepreneurship can be summed up with a few points:

- Current SBA loan terms are very favorable.

- The SBA is moving to make more loans available to buyers.

- There are many motivated business sellers.

- Recession proof businesses like home services companies are available to be purchased.

When you take in all of these considerations, Acquisition Entrepreneurship remains one of the best and safest investment opportunities in the United States, regardless of whether there is a recession or not.

If you’re interested in buying a business, Acquira’s Accelerator Program will train you how to source, vet, and buy a small business of your own. It was designed to help you close on a business in half the time and at half the cost as it would take you to do it on your own. To learn how we can help, schedule a call with one of our representatives today through the form below.

Key Takeaways

- The SBA is making it easier for people to get loans to buy a business.

- The terms on those loans are very favorable.

- Buying a home services business during a recession can be a great opportunity.

- Recessions often present an opportunity to have favorable terms and valuations with sellers

- An investment in digital marketing can grow a company’s total addressable market by an exponential amount

Acquira specializes in seamless business succession and acquisition. We guide entrepreneurs in acquiring businesses and investing in their growth and success. Our focus is on creating a lasting, positive impact for owners, employees, and the community through each transition.