- How to perform an initial assessment of a business to buy

- How to estimate the market value of a business

- The important steps in performing your due diligence

- How you can secure funding for your business purchase transaction

If you’re not a veteran acquisition entrepreneur, then you probably do not have a systemized method to close great business purchase deals consistently.

In this article, we’ll give you a checklist for buying a small business that’s tested and proven to make your purchase move smoothly to a successful close.

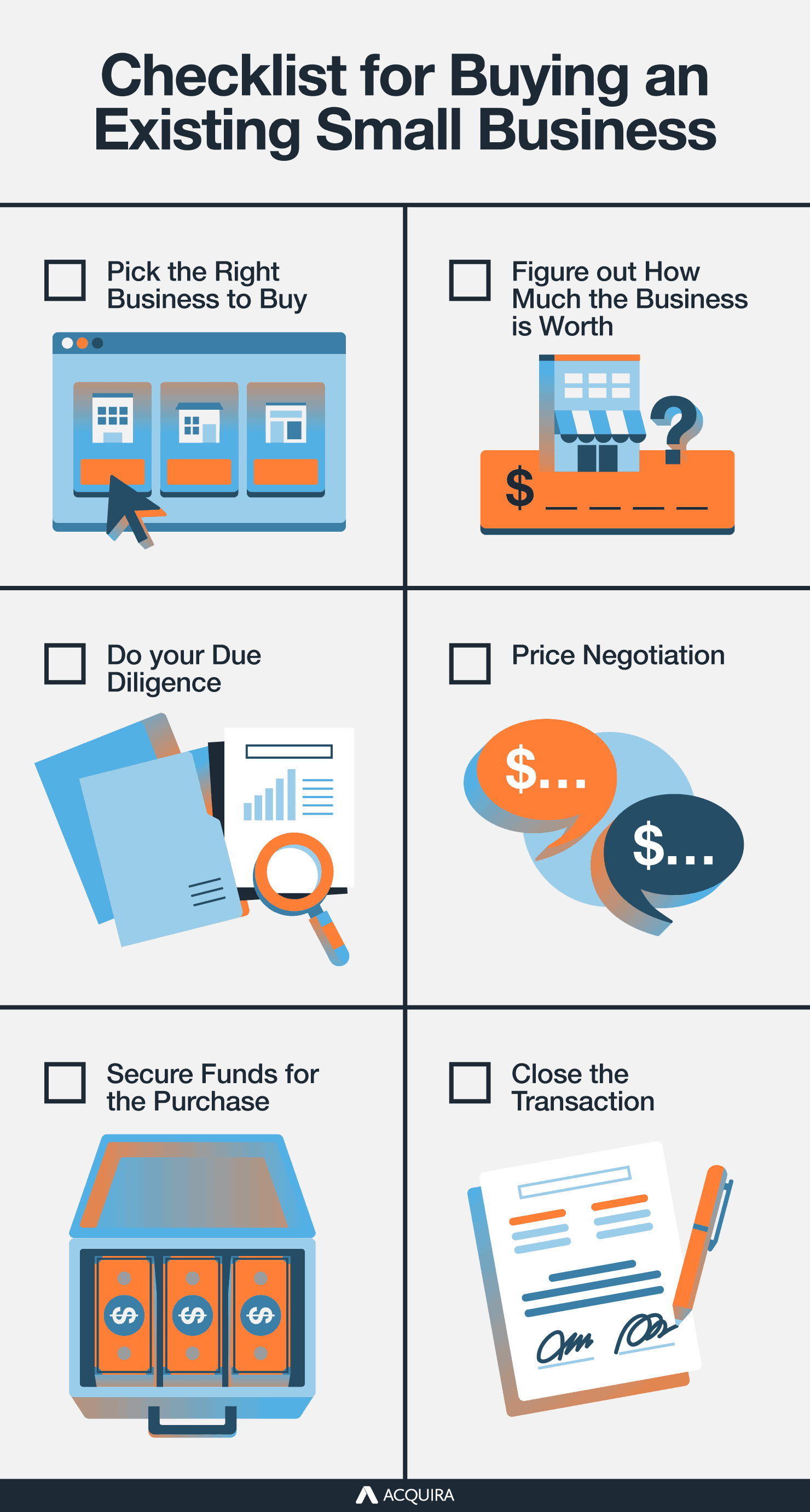

Checklist for Buying an Existing Small Business

Before you get started on purchasing an existing small business, it’s smart to get a few things in order first. This way, you avoid your offer falling through the cracks and losing a great opportunity.

Many sellers pre-qualify their potential buyers before deciding on who to move forward with on the deal. Ensure you have the experience and/or knowledge to own the business you have your eyes on. You need a concrete plan for how you will handle business operations.

Besides choosing a business that fits your experience, knowledge, and passions best, you’ll need funding, legal and accounting help, and preparation for a long purchase—about 8 months.

So, let’s dive into your concise checklist for buying an existing business:

1. Pick the Right Business to Buy

You can start your search with your interests and expertise. If you’ve worked as a service technician in a plumbing company in the past and loved it, you can make the simple decision to buy a profitable plumbing business.

You can find a business for sale on

However, when it’s time to narrow down your choices, you’ll want to ask more in-depth questions. For instance, why is the business on sale? Is it because the owner wants to retire, or a court case has bankrupted the company?

Understand why the business is on sale to avoid buying a problem. Learn about the business history, operations, challenges, and if it has the potential to succeed. Talk to the employees, surrounding businesses, and customers to gather as much insight as possible.

Don’t underestimate the value of a deep conversation with the owner. You can learn vital details you won’t see on paper.

2. Figure out How Much the Business is Worth

You can draw up your own estimate of the business’s value. Usually, businesses are valued based on multiples of their EBITDA. This multiple varies according to the size of the business.

- 2-3x for businesses priced less than $3m

- 3-5x for businesses priced between $3m – $20m

- 5-10x for large businesses priced over $20m

However, the best person to value a business is an appraiser. They have a detailed technique for coming up with more accurate numbers.

3. Do your Due Diligence

This is the most detailed item on your checklist. It takes about 3 months to complete due diligence. For the best results (and minimal errors), you need a professional accountant and business lawyer by your side for this one. If you’re using our program and chatting with our team, you’ll have access to our vendors for this process too.

Due diligence involves getting intimate with the business on paper. The seller will give you access to vital documents, files, contracts, and statements belonging to the business. This way, you can gather enough information about the business to make an informed decision.

Usually, the seller will require you to sign a non-disclosure agreement to protect the confidentiality of the information you’ll unravel in this process.

Just in case you decide not to move forward with your intent to buy because of something you unraveled, they won’t want you discouraging others with that information.

Important documents to go through during your business purchase due diligence stage are:

Financial Documents

Such as balance sheets, cash flow statements, debt disclosures, tax returns, sales records, accounts payable, and advertising costs.

With your CPA by your side, analyze these documents. Find out if the business is making money and/or can make money going forward.

Contracts and Agreements

Review all agreements with suppliers or customers and ensure everything is okay. You may find a red flag here, so pay close attention.

Leases

Find out if the landlord is fine with transferring the lease of the business location (or equipment) over to you. If not, you’ll have to revisit the price of the business.

Licenses and Permits

Find out if the business, especially those in regulated industries like healthcare and food, have the required licenses and permits to operate.

Letter of Intent (LOI)

The seller should issue you an LOI detailing the agreed price, assets and liabilities included in the sale, and the terms and conditions of the transactions. This certifies that the seller wants to complete the deal.

Other Documents

Intellectual property rights, inventory, certificate of good standing, compliance with environmental regulations, compliance with zoning laws, and brand assets.

Review these documents—ideally, with a lawyer—and ensure you’re satisfied with the information you discover before proceeding.

4. Price Negotiation

This step can make or break the deal. Obviously, people are unique and value the business differently. The goal is to agree on a price.

If both parties involved in the deal use an appraiser or business valuation firm, this step can move smoother. Although their services cost between $3,000 to $5,000, nailing the right price for the purchase can save you way more than that.

Also, during this stage, you’ll typically negotiate how long the seller will stay on board after the sale. You may need the seller to stick around to transfer everything and assist with the transition before totally letting go.

5. Secure Funds for the Purchase

It’s easier to secure funding to buy a business than to start a business. So you’re on the right track with several options for capital, such as

- Your own funds

- Funds from a partnership

- Seller financing — where the seller lends some part of the money in exchange for a periodic payment

- Equity financing — where you sell some company stocks to the employees to get capital

- Debt financing — loans such as term loans, SBA loans, asset-based loan

- Leasing the business — as opposed to making a full purchase

You and the seller will have to agree on a method (or combination of methods) before moving forward with the sale.

6. Close the Transaction

The last item on your checklist for purchasing a business is the close. You still require certain documents to certify that you’re now a full owner of the business after every other step is complete.

Get a bill of sale (an official document proving a completed transaction and change of ownership) as well as

- Adjusted purchase price

- Lease

- Vehicles (if available)

- Intellectual property (patents, trademarks, and copyrights)

- Non-compete agreement (so the previous owner doesn’t start a new business and compete against yours), etc.

Should You Buy a Business?

Starting a business is a wise financial decision. You get the freedom to pursue something you’re passionate about with income you control. It’s the American dream.

However, building a business—no matter the size—is laborious and risky. 50% of small businesses fail, and only 9% make it past 10 years. This can deter an aspiring entrepreneur.

There’s a better direction to take: Buy an existing business. Here’s why:

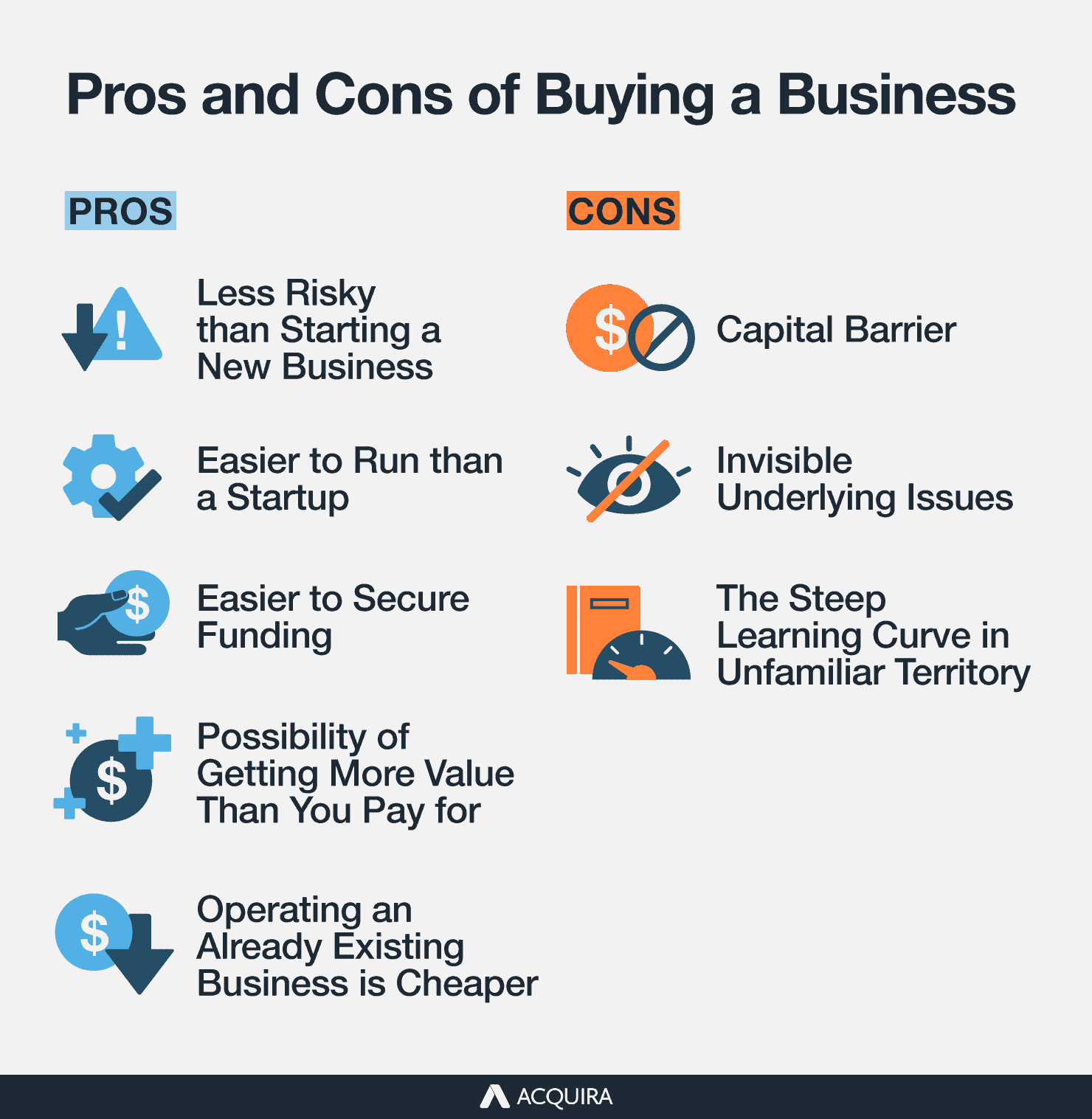

Pros of Buying a Business

- Less Risky than Starting a New Business – You’ll be taking ownership of a business that’s been proven to work for decades after someone else has borne the risks and headaches of taking it from scratch to a stable condition. Then it becomes a source of income (even passive income, if you want) without the grit and labor.

- Easier to Run than a Startup – You’ll have the office space, customer base, equipment, employees, supplier base, etc., needed to keep a business thriving. All without the usual initial struggle. They may not always be in great condition, but it’s a better starting position than position zero.

- Easier to Secure Funding – It’s easier to get funding for a business purchase than it is for starting a business. That’s because financiers favor a venture that has stronger evidence of working. And it is easier to prove that with the financial documents of an existing business than with the plan of a business you want to start from scratch.

- Possibility of Getting More Value Than You Pay for – Buying a business can come with a better value than paying for intellectual property. If the business has patented products, copyrighted taglines, or trademarked logos, you can often take ownership of these during the sale. This can represent a terrific foundation to expand the business further and grow its value.

- Operating an Already Existing Business is Cheaper – You can start with a lower operating cost than a business just off the ground. Since most essentials are already in place for the business, you spend less to run the business than a startup. This leaves more funds for rapid expansion.

Cons of Buying a Business

On the other hand, it is not always a rosy road to walk when buying a business. Some disadvantages are:

- Capital Barrier – It's hard to fund an acquisition deal with the steep upfront cost of buying a business. While saving money on capital and initial operating costs, you pay more for the other business elements that take years to build. These other elements include customer base, business assets, intellectual property (copyrights, trademarks, and patents), business plan, brand, etc.

- Invisible Underlying Issues – You can never know the invisible details about the business. Sometimes you may find something unpleasant after the purchase has been completed. For example, poor online reputation or outstanding legal issues. This is why the due diligence process exists: minimizing buyer's remorse risk.

- The Steep Learning Curve in Unfamiliar Territory – The learning curve for some businesses is tricky to navigate. It may be a business in a familiar field, but the details of business operations can elude you. Since you’re just coming on board, you won’t be fully familiar with the ropes. It’s worse if you have no experience or knowledge in the field.

Key Takeaways

Buying a small business instead of starting one from scratch is a smart financial idea. Operation costs are lower, securing funding for the purchase is easier, and you’ll be buying a proven source of income.

To get started, here’s your checklist for buying a business:

- Pick the right business to buy

- Figure out how much the business is worth

- Do your due diligence

- Negotiate a price

- Secure funding for the purchase

- Close the transaction

Work with professionals during these steps to avoid expensive errors. You need an accountant to audit the business’s financials and a lawyer when reviewing legal documents.

If you'd like to buy an existing business yourself, Acquira's training will teach you how to find and appraise a business. We'll walk you through negotiating the final closing price and drawing up the proper documents. But space in each cohort is often limited, so apply to the Accelerator Program now to hold your spot .

Acquira specializes in seamless business succession and acquisition. We guide entrepreneurs in acquiring businesses and investing in their growth and success. Our focus is on creating a lasting, positive impact for owners, employees, and the community through each transition.